Inflation, rate increases, hit and miss earnings results, and the looming threat of a Russian invasion of Ukraine, the challenging price volatility is likely to continue in the week ahead. While the bears are fighting to defend the recent lower high and downtrend, the bulls are fighting to hold a higher low after last week’s rally. As a result, traders will have to remain nimble as we move toward a look at inflation Thursday morning that could push higher given the surging oil prices. Should Russia invade as the U.S. government suggests, all bets are off, and anything is possible, so plan your risk carefully.

Asian markets traded mixed with Shanghai jumping higher by 2.03% after the holiday break. European markets trade in a choppy early session but currently show modest gains when writing this report. U.S. futures are off the overnight lows yet continue to point to a modestly lower open ahead or earnings data a lite economic Monday calendar.

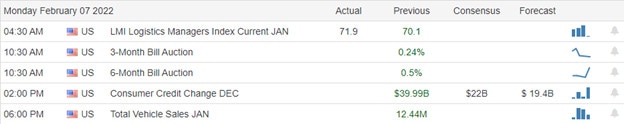

Economic Calendar

Earnings Calendar

We kick off the new trading week with about 70 companies on the earnings calendar. Notable reports include ACM, AMGN, ACLS, CRNC, CHGG, ENR, HAS, LEG, L, NUAN, ON, RMBS, SPG, TTWO, THC, TSN, & VRNS.

News and Technicals’

Macron will meet with Putin in an attempt to avoid a Russian invasion. “It is indispensable to avoid degradation of the situation before we build mechanisms and gestures of reciprocal trust [with Russia], “France’s President Emmanuel Macron said in an interview. Monday’s meeting in Moscow is crucial for the French president, who has been pushing for a more independent European Union in terms of defense. In recent weeks, tensions between Russia and the West over Ukraine have ramped up significantly. As global powers have scrambled to prevent an all-out war between Ukraine and Russia, Germany has been accused of actively failing to help defend Ukraine from a possible attack. Germany has refused to send military hardware to Ukraine, unlike other countries. Ukraine is not a member of the EU or NATO, and Germany has a conundrum over its dynamics with Russia when it comes to energy. Protesters have shut down downtown Ottawa for the past eight days, with some participants waving Confederate or Nazi flags and some saying they wanted to dissolve Canada’s government. Ottawa police said issued hate crime charges against four people, and they were investigating threats against public figures jointly with the U.S. Federal Bureau of Investigation. The well-organized blockade, which police say has relied partly on funding from sympathizers in the United States, saw protesters bring in portable saunas on Saturday to combat frigid temperatures. Treasury yields moved lower in the early Monday trading, with the 10-year dipping to 1.9014% and the 30-year falling to 2.1934%.

With the looming threat of a Russian invasion of Ukraine, an earnings calendar chalked full of reports, and a rate increase just around the corner, the challenging price volatility is likely to continue. The bulls and bears are locked in a battle for control, with the bulls fighting to hold a higher low and the bears fighting to enforce the current lower high and downtrend. Oil continues to surge higher, raising concerns that the CPI number on Thursday morning will show another increase in inflation. The T2122 indicator indicates we still have room to move down before reaching a short-term oversold condition. That said, with the futures rising off the overnight lows in the pre-market pump, we should not rule out the possibility of a test lower. Even with all the selling, the SP-500 P/E ratio remains 82% above the historical average suggesting stock valuations remain high. Given the hit and miss earnings results this quarter, we have a challenging spring and summer if the rising rates slow the economy as prescribed. Should Russia invade, all bets are off, and anything is possible, so plan your risk carefully in the week ahead.

Trade Wisely,

Doug

Comments are closed.