With the CDC warning of a substantial coronavirus breakout in the US markets extended its losses with the Dow sinking more than 1900 points in the just 2-days. There was such a demand for the relative safety of treasury bond the 10-year yield fell to a record low and oil dropped below $50 a barrel. What happens next is anyone’s guess as markets around the world grapple with the economic uncertainty of this very contagious outbreak.

Asian markets closed in the red across the board and European markets continue to sell off this morning. US Futures have been all over the map this morning facing a big day of earnings and economic reports. With trends and key support levels broken we can expect highly volatile price action to continue as we sort through the wreckage of the last 2-days.

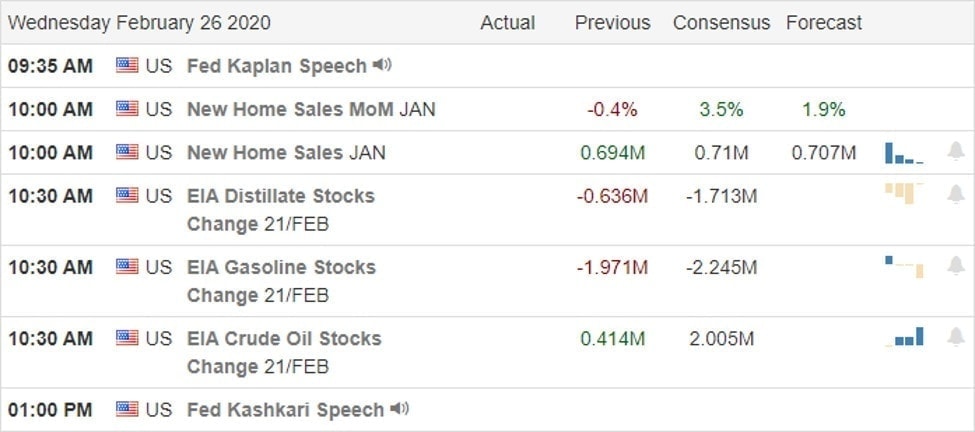

On the Calendar

On the hump day earnings calendar, we have more than 250 companies reporting quarterly results. Notable reports include LOW, SQ, TDOC, AMCX, APA, BKNG, BOX, CARS, CNVA, CHK, DAKT, EV, ETSY, STAY, TWNK, SJM, KW, LB, MAR, MNST, NTES, NDLS, ODP, PZZA, DOC, SEAS, TJX, TCOM, UPWK, VIPS, WB, WEN & WYND.

Action Plan

After a 2-day selloff that dropped the Dow more than 1900 points triggering more market selloffs around the world. With the CDC now expecting a substantial breakout to occur in the United States 10-year treasury bonds dropped to their lowest levels in history while oil fell below $50 a barrel. Travel stocks such as airlines, cruise lines and travel booking company’s plummetted as did health insurers and health care related stocks. The South Korea outbreak jumped to nearly 1150 confirmed cases and reported 11 deaths. With possible vaccine’s still months away it would seem this situation will get significantly worse before it gets better. The uncertainty of the potential economic impacts is likely to keep the market on edge and volatile in the weeks ahead.

With trends broken and prices slicing through multiple price support levels all at once traders will find it very difficult to find there way back into the market with the high risk of news-driven reversals. During the night US Futures whipsawed from triple points up to triple points down as shellshocked trader’s emotions continue to vacillate. Normally one would assume we have reached a short-term oversold condition a relief rally is due to begin but this is not a normal situation and traders should prepare for just about anything. With a huge day of earnings reports and a couple of key economic reports on the calendar expect highly volatile price action to challenge even the most experienced traders. Remember cash is a position and there is no shame in watching from the sidelines as the uncertainty continues to unfold.

Trade Wisely,

Doug

Comments are closed.