The talking heads continue to sing in chorus to buy the dip, but It would seem their wide-eyed speculation will punish them this morning with a significant overnight reversal. Emotions are very high, and the truth is we still don’t know anything about the new variant and if it will have economic impacts! However, we do know that markets hate uncertainty! Uncertainty increases price volatility and, at the same time, removes a trader’s edge. Therefore, I continue to suggest caution. Avoid gambling, watch, wait, protect your capital until your edge returns.

Asian markets struggled for direction overnight mixed results, with the Nikkei down 1.63% followed by Hong Kong down 1.58%. European markets trade decidedly lower across the board this morning as traders grapple with the sharply declining global sentiment. U.S Futures have bounced off of overnight lows but continue to suggest a substantial reversal at the open, with Powell and Yellen headed to the hill to testify. So buckle up for another day of uncertainty.

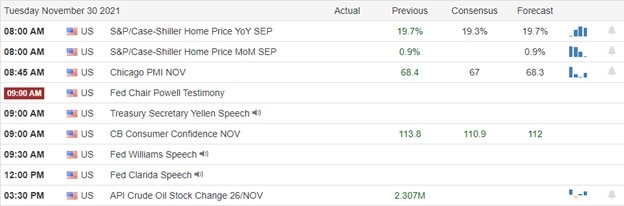

Economic Calendar

Earnings Calendar

We have a bit more earnings activity today, with 31 companies listed with several unconfirmed. Notable reports include AMBA, BNED, BOX, CHS, CTRN, FRO, GFS, MOMO, HPE, NTAP, CRM, & ZS.

News & Technicals’

Moderna CEO Stephane Bancel told the Financial Times that he expects vaccines to be less effective against the new strain. As a result, Asia and European stocks fell on Tuesday; U.S. futures were also in the red. The moves lower come after European and U.S. stocks attempted a relief rally on Monday. Many unknowns surround the new omicron Covid variant; early signs indicate it’s more transmissible, but we don’t yet know what risks it poses to public health. However, global market sentiment nosedived on Tuesday morning amid fears that the Covid-19 vaccine currently in use could be less effective against the new omicron variant. Fed Chair Jerome Powell believes that the omicron variant of Covid-19 and a recent rise in coronavirus cases pose a threat to the U.S. economy. Worries over the new variant could “reduce people’s willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions,” he said in prepared remarks. Treasury Secretary Janet Yellen will join Powell on Tuesday in testifying before the Senate Banking Committee on Tuesday. Treasury Yields declined sharply in early morning trading, with the 10-year falling nine basis points to 1.4324%nd the 30-year declining six basis points to 1.8139%.

Although we saw a nice bounce yesterday as the traders tried to shrug off the possible impacts of the new variant. Though there is a chorus of talking heads suggesting buy the dip, I continue to be cautious because we don’t really know anything at this point. Currently, markets are highly speculative and combine that emotional energy with significant uncertainties, and anything is possible. The current price volatility favors intraday traders can prove t be very damaging to swing trading accounts. This morning we look to open with a significant overnight reversal that will be proof positive there is no edge in buying the dip in wide-eyed speculation. Gamble if you must, but as for me, I will stand aside, protect my capital and wait for my edge to return.

Trade Wisely,

Doug

Comments are closed.