The bears made some halfhearted attempts in yesterday’s early session, but the bulls won the day with modest gains still seemingly challenged by overhead price resistance. With a big day of earnings data to digest and jobless numbers on the way, U.S. futures point to mixed and flat open at the time of writing this report. Traders will need to remain nimble as we head into the Friday Employment Situation number, although government deficit spending appears more critical to the market nowadays.

Asian markets closed in the red across the board even as Hyundai shares rose with an Apple Car deal drawing closer. European markets trade mixed and cautiously as the Bank of England stands frim on interest rates. As morning earing roll out, the U.S futures trade mixed and mostly flat but prepare for price volatility as traders and investors digest all the data.

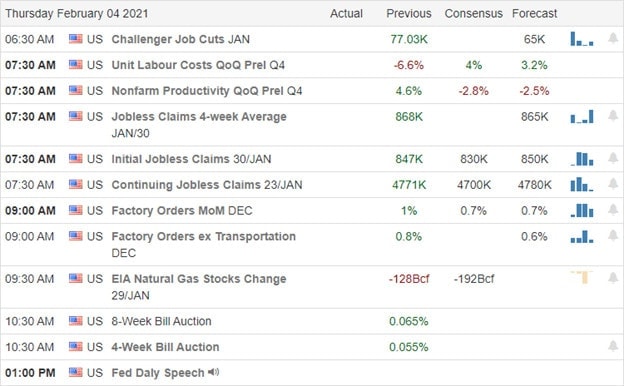

Economic Calendar

Earnings Calendar

Today is our busiest day on the earnings calendar this week, with nearly 120 companies fessing up to results. Notable reports include PTON, ABB, ATVI, APD, ALL, ABC, AINV, BLL, BDX, BMY, BEP, CG, CI, CLX, COR, CMI, DECK, DB, F, FTNT, GILD, GPRO, MRK, MCHP, MSGN, NWSA, NOLK, OIH, PENN, PM, PINS, POST, DGX, RL, SKK, SNAP, SNA, SU, TMUS, TPR, TDC, U, XYL, YUM & ZEN.

New & Technicals’

Although we had a modest day of price action, the bulls remain in control while still challenged by overhead price resistance levels. With a big day of earnings and economic news, traders will have to say on their toes, ready for just about anything. Apple and Hyundai-Kia said they are moving toward a deal to begin the development of the Apple Car. American Airlines is once again warning that 13,000 employees could be furloughed next month without additional federal aid. Senator Amy Klobuchar has unveiled a sweeping antitrust reform bill that could draw more risk and scrutiny to large tech firms if enacted. Google and Facebook already face federal and state lawsuits, with enforcers eyeing anticompetitive conduct accusations against Amazon and Apple as well.

The bulls-maintained control yesterday amidst some halfhearted attempts by the bears during the morning session. Overall the indexes are still challenged by overhead price resistance, and with a big day of data coming our way its anyone’s guess which side gains the upper hand, bull or bears. That said, the sharp decline in the VIX-X the last few days is a welcome sight even though it’s still remarkable to see markets poised to make new highs with the VIX over 20 handles. Stay focused and flexible with jobs data in focus for the rest of the week.

Trade Wisely,

Doug

Comments are closed.