Though Thursday brought us another negative GDP, sharply rising bond yields, and declining corporate profit figures, the bulls said I don’t care, get out of my way so I can buy something. Their effort held index price support levels, and the VIX indicated fear continues to diminish. Although the number of earnings declines sharply today, inspiration will come in from economic reports and the Jerome Powell speech from Jackson Hole at 10 AM Eastern. With the Chairman expected to deliver a hawkish tone, how the market might react is anyone’s guess, so plan carefully and expect some wild price volatility.

Asian market mostly rises, with only Shanghai seeing a little red to close the week. However, European markets see mostly red in a choppy session as they cautiously wait for Powell’s comments. Likewise, U.S. futures point to a bearish open with pending economic data and all eyes on the Jackson Hole speech from the Chairman and what it might mean for the future market direction! So, buckle up the show is about to begin!

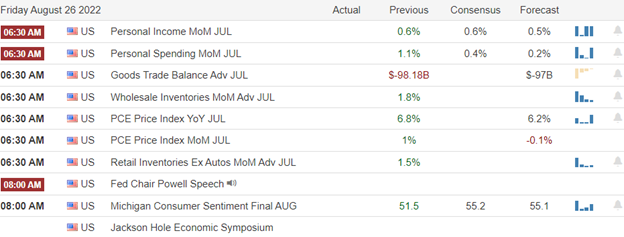

Economic Calendar

Earnings Calendar

The number of earings drop off shrply today with only 13 listed and just 5 confrimed. Notable reports include JKS, & SNP.

News and Technicals’

Fed Chairman Jerome Powell speaks Friday at 10 AM. ET in a much-anticipated appearance at the Federal Reserve’s annual Jackson Hole, Wyoming, symposium. Fed watchers do not expect a new message from the Fed chairman, just a tougher version of the central bank’s promise to slow inflation by raising interest rates. Powell is likely to emphasize that the Fed is unlikely to quickly reverse course after it reaches an end rate, as the futures market has been expecting. “I think we only need 100 basis points more,” Wharton business school professor Jeremy Siegel told CNBC’s “Squawk Box Asia.” “The market thinks it’s going to be a little more — 125, 130 basis points more. My feeling is we won’t need that much because of what I see as a slowdown.” “If you want to do it all at once, or you want to do it over a period of two to three meetings — it won’t make that much of a difference,” he said. U.S. Federal Reserve Chair Jerome Powell is slated to speak at Jackson Hole later on Friday, where he’s likely to emphasize that the Fed will use all the firepower it needs to snuff out inflation. U.K. energy bills to rise by 80%! The new cap will be in effect from October 1 to the end of the year, which is expected to rise further. The government is under pressure to announce greater support for households and a wide-ranging plan to oversee the energy supply industry through a crisis. However, the candidates to be the new prime minister have said a comprehensive strategy needs to wait until the leadership election on Sept. 5. A Chipotle Mexican Grill restaurant in Lansing, Michigan, became the chain’s first location to vote to unionize. Workers at the store voted 11 to three in favor of unionizing under the International Brotherhood of Teamsters. The win for Chipotle organizers in Michigan comes on the heels of more than 200 Starbucks cafes in the U.S. voting to unionize in the last ten months. Treasury yields ticked moved higher in early Friday trading, with the 12-month at 3.26%, the 2-year at 3.38%, the 5-year at 3.20%, the 10-year at 3.07%, and the 30-year at 3.28%.

With a negative reading on the GDP, declining corporate profits, and mixed earnings results, the bulls said don’t care, get out of my way so I can buy something, as they defended the index chart price supports. Can they keep up that enthusiasm while likely facing a hawkish Jerome Powell speech from Jackson Hole? We should also remember that on Sept. 1st, the Fed will tighten the money supply by rolling off 90 billion from their balance sheet. So far this week, the market has largely ignored the weakening economic reports, so how they react to today’s International Trade figures, Personal Income and Outlay, Inventory data, and Consumer Sentiment is anyone’s guess. I would, however, suggest we could see substantial price volatility around the Chairman’s speech at 10:00 AM Eastern so plan carefully.

Trade Wisley,

Doug

Comments are closed.