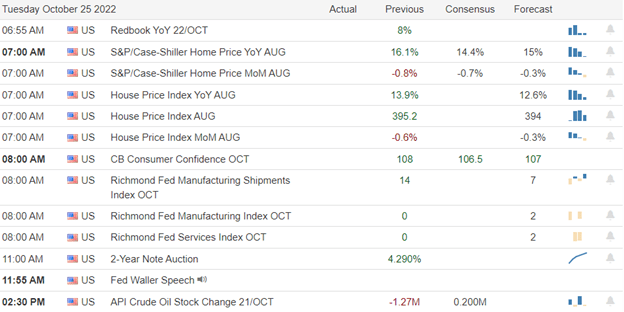

The bulls maintained control on Monday through the huge-point morning whipsaw, highlighting the danger of highly emotionally charged price volatility. The PMI number, though ignored, provided context to the relief rally uncertainty as the U.S. economic growth declined. All eyes will be on the tech giants GOOGL and MSFT earnings results after the bell though we will have to deal with Case-Shiller and Consumer Confidence numbers during the morning session. Expect the wild price gyrations to continue, and plan for substantial morning pops or drops depending on the big tech reports.

While we slept, Asian markets whipsawed in a volatile session to close mixed on the day. With HSBC down 6% this morning, European markets trade mixed with eyes on earnings results. However, U.S. futures point to a modest pullback at the open as they wait in hopeful anticipation of the GOOGL and MSFT reports while dealing with those pesky economic reports that continue to suggest an economic slowing is underway. Anything is possible, so plan carefully in this hyper-emotional market condition.

Economic Calendar

Earnings Calendar

We have nearly 90 companies listed on the Tuesday earnings calendar with the kickoff of big tech reports after the bell today. Notable reports include MMM, AGYS, AMD, AXTA, BYD, BIIB, CLF, CC, CMG, CB, KO, GOOGL, GLW, ENPH, FFIV, GE, GM, HAL, ITW, JBLU, JNPR, KMB, MAT, MSFT, NVR, PHM, RTX, SHW, SKK, SPOT, TXN, UPS, VLO, V, WH, &XRX.

News & Technicals’

UPS reported revenue that fell below analyst expectations and earnings per share that beat them. The United Parcel Service said declines came from its supply chain solutions division, which includes freight forwarding. However, the company reaffirmed its full-year guidance of $102 billion in revenue and adjusted operating margin of 13.7%. Ford Motor is updating its popular Escape as part of a two-pronged sales strategy alongside the newer, more rugged Bronco Sport. The starting price for the 2023 Escape ranges from roughly $29,000 for an entry-level model to $40,000 for a plug-in hybrid electric vehicle. The goal is to differentiate the mainstream Escape from the more rugged Bronco Sport, allowing each vehicle to form a niche in the compact vehicle segment.

Britain’s new Prime Minister Rishi Sunak set to take office Tuesday, assuming with it one of the most daunting political inboxes in modern British history. The former finance minister will be tasked with remedying multiple crises, including soaring inflation, higher energy costs, industrial unrest, and a battered economy. Sunak has warned that the U.K. faces a “profound economic challenge” and pledged to instill “stability and unity.”

UBS aims to improve its Asia-Pacific business, and CEO Hamers said he sees “some opportunities to grow” in China. The investment banking division saw revenues down by 19%, with the lower performance in equity derivatives, cash equities, and financing revenue offset by foreign exchange revenues. The Global Wealth Management division also reported lower revenues, down by 4% year-on-year.

Although we experienced a large morning gap and whipsaw, the bulls maintained control into the close as prices stretched into resistance levels as the Dow surged through its 50-day average. Today we will have to deal with Case-Shiller, Consumer Confidence numbers, and a bevy of earnings results that will include the market-moving reports from MSFT and GOOGL. Perhaps that will fix the imbalance of the indexes, with the SPY and QQQ lagging behind the surging DIA. With the hype and emotion of earnings, the markets can undoubtedly move higher but keep a close eye on the substantial overhead resistance levels for possible entrenched bear attacks. As a result, price volatility will likely remain highly challenging, giving experienced day traders the advantage. With all eyes on the giant tech results, we should also plan for big-point morning pops or drops that could extend the relief rally or quickly reverse the direction. Plan your risk accordingly.

Trade Wisely,

Doug

Comments are closed.