US Futures are pointing to positive open ahead of the Employment Situation number at 8:30 AM Eastern and learning a trade deal with China could happen in the next four weeks. Yesterday the bulls appeared to have little concern about the deal with the DIA confidently breaking through price resistance catching up with the SPY and QQQs already above key levels. Even the IWM joined in with bullish day although still below previous highs.

The bulls now have a clear path to test all-time market highs and perhaps set new records assuming support levels hold. Profits have been pretty easy to come by this week but don’t let greed prevent you from taking at least some of those to the bank before the weekend. Through bulls may have their eyes on new market highs we never know what the future holds. Profits today can be gone on Monday so plan your risk carefully into the weekend.

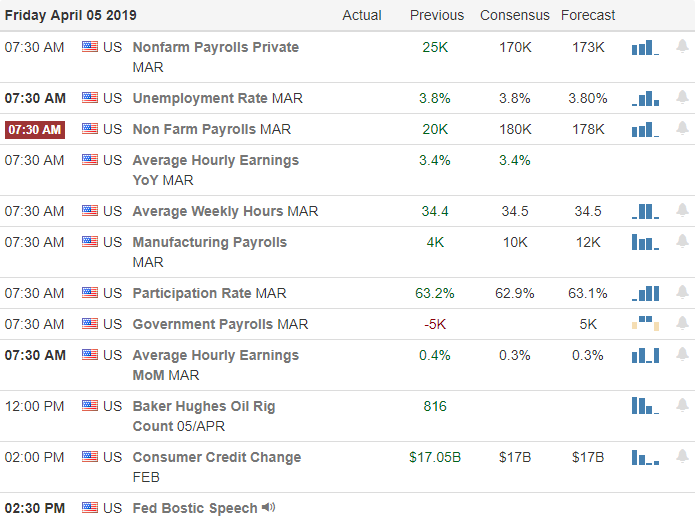

On the Calendar

We only have eight companies reporting earnings today with none that are particularly notable.

Action Plan

I must admit that yesterday turned much better than I expected as we waited to hear news about a trade deal with China. The bulls appeared to have total confidence of a positive outcome providing another nice day of gains rather than the consolidation I was expecting. More than that it appears the bulls have more upside energy this morning with futures pointing to bullish open ahead of the Employment Situation report. The consensus is expecting a nice rebound in the employment number to 170K after last months disappointing reading of just 20K.

Yesterday’s price action was also a big day the market on a technical basis with the DIA breaking through resistance with the SPY and QQQ proving to hold strong above new supports. Even the IWM got with program putting in a bullish day though still a lower high at this point. It’s been a great week of gains and as we head into the weekend its wise to remember your trading plan and goals, taking profits as necessary. I wish you all a great weekend.

Trade wisely,

Doug

Comments are closed.