The US Futures are suggesting the 3rd straight day of bullishness this morning wish is something the Dow has not seen since the 30th of November. Trade negotiations with China continue today, and according to reports progress is being made, and hopes for an agreement are rising. As we enter day 18 of the government shut down the President will bring his case the people this evening from the oval office. A move, that is sure to create a firestorm of Washington spin and could affect market volatility throughout the day and overnight.

The morning gap raises the possibility of a pop and drop pattern so traders should be careful not to chase into the open until we see if there is follow-through buying that supports the gap. With all the political news swirling traders should stay focused on price action and prepared for whipsaw and quick price action.

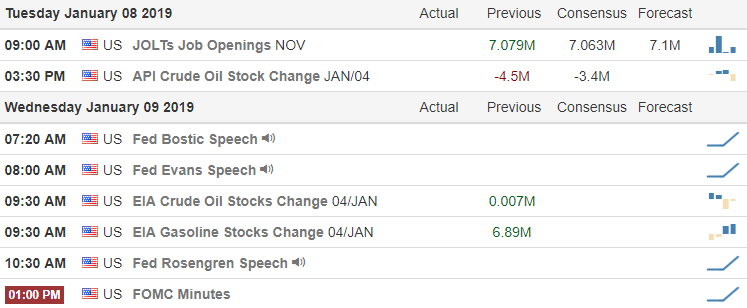

On the Calendar

On the Earnings Calendar, we have 15 companies reporting with HELE and LNN as the most notable both of which report before the open today.

Action Plan

With two days of bullish price action behind us, the 3rd day in a row with a bullish close a condition not seen since November 30th. Although we are in the 18th day of the Federal Government shutdown, the US Futures are pointing to bullish open this morning with a gap up of more than 150 points. The bullish sentiment appears based upon the positive reports that the US and China trade negations are making progress that may soon result in a deal.

The President will be speaking from the Oval Office this evening taking the border wall debate directly to the people. Expect the political spin to reach new heights and keep in mind the market could be very sensitive to the reports. With a large gap up this morning, we will need to be on the lookout for a possible pop and drop unless buyers prove the ability to support the gap. Please keep in mind that that T2122 is in the bullish reversal zone. That does not mean a selling is imminent, but it does suggest a short-term overbought condition that we must respect when considering new long positions. Today could prove to be a bumpy ride so stay flexible and focused on price action.

Trade Wisely,

Doug

Comments are closed.