A GOOGL revenue miss, an outbreak continuing to expand, and a sputtering conclusion to the Iowa caucuses remarkably and somewhat confusingly inspires a bullish charge this morning. We have a very big day of earnings and this huge gap up is likely to trigger a painful short squeeze for traders caught short. As we seemly shake off any concerns of the outbreak economic impacts focus on the price action and the fact we are gaping right into price resistance levels. Chasing this creates a large risk to support levels if, like yesterday virus new spoils the bullish party.

Asian markets close in the green overnight with the Shanghai composite bouncing 1.34% after yesterday’s plunge. European markets also advance this morning, reacting to earnings and shaking off virus concerns. As we approach the open US Futures, continue to climb ahead of a big day of earnings and economic news. Hang on today would be a wild ride!

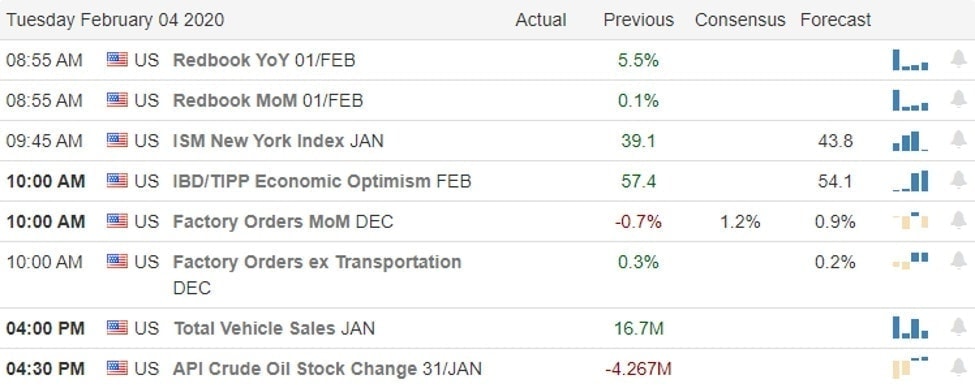

On the Calendar

On Tuesday earnings calendar we have a big day with 153 companies reporting quarterly results, Notable reports include CMG, DIS, AFL, AGN, ALL, ATO, BOOT, BP, CNC, CB, CLX, COP, CMI, EMR, FISV, F, GILD, LHX, LII, MTCH, MCK, PBI, PAA, RL, RCL, SBH, STX, SPG, SIRI, SNAP & SNE.

Action Plan

Futures created a big gap and steep rally, and then virus fears once again brought in the bears after a report that a cruise ship passenger contracted the disease 6-days after departing the ship maybe infecting other passengers. After the bell, yesterday GOOGL somewhat disappointed investors beating earnings estimates but missing on revenues falling about $45 a share. Despite the disappointment and the virus deaths reaching 425 with nearly 20,500 infected futures are flying high this morning as markets choose to shake off and ignore previous concerns.

As I write this report, US Futures point to a 300 point gap! I can’t find anything in the news that justifies such a gap, but clearly the institutions what a return to bullishness. This mornings gap could easily trigger a short squeeze rally forcing the markets higher still. I don’t understand where the bullishness is coming from but the good news is I don’t have too. My job is not to understand the wild emotional swings this market makes. My responsibility is to maintain focus & discipline to my rules and my trade plan. Unfortunately, a gap of 300 points is likely to create increased risks that may prevent me from entering trades. I will not chase with a fear of missing out as the market gaps into price resistance.

Trade Wisely,

Doug

Comments are closed.