Indexes advanced slightly on Wednesday building on the gains as the relief rally continued on a low-volume day. The hesitation likely has a lot to do with the wait on the Core PCE numbers coming out before the bell this morning and what that might mean for future Fed decisions. Along with several notable earnings reports we also have Jobless Claims, Chicago PMI, and Natural Gas numbers to provide buy or sell inspiration. Keep in mind we have the Employment Situation number Friday morning as we slide into a busy travel 3-day weekend.

While we slept Asian markets closed mixed as China’s factory activity contracts for the 5th month in a row. European markets also trade mixed this morning as they try to celebrate the UBS earnings while dealing with higher inflation data. The U.S. futures also trade mixed this morning as we wait on potential market-moving jobs and inflation data.

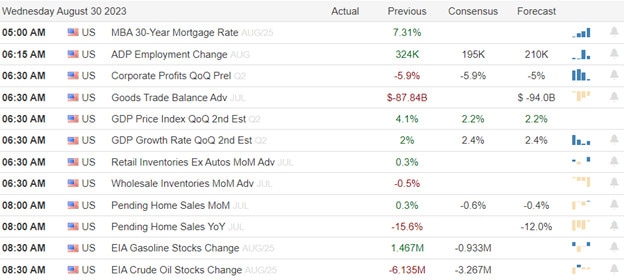

Economic Calendar

Earnings Calendar

Notable reports for Thursday include ASO, AVGO, DELL, DOOO, CAL, CPB, DG, GCO, LULU, MOMO, HRL, MDB, NTNX, OLLI, GIS, TITN, VMW, UBS.

News & Technicals’

China’s manufacturing sector continued to shrink in August, indicating that the world’s second-largest economy is facing persistent headwinds from both domestic and external factors. According to the official data released by the National Bureau of Statistics (NBS), the manufacturing purchasing managers’ index (PMI) rose slightly to 49.7 in August, from 49.3 in July, but remained below the 50-point threshold that separates expansion from contraction. This was the fifth consecutive month that the index showed a contraction, and worse than the median forecast of 49.2 by economists surveyed by Bloomberg. The NBS attributed the weak performance to the impact of floods, typhoons, and COVID-19 outbreaks in some regions, as well as the slowdown in global demand and supply chain disruptions. The sub-indexes for production, new orders, and new export orders all improved slightly from July but still stayed in the contraction zone. The sub-index for employment also fell further to 48.1, suggesting that manufacturers were cutting jobs amid the downturn. The NBS said that the manufacturing sector faced “increased difficulties and pressures” and called for more policy support to stabilize production and market expectations.

The euro zone’s inflation rate remained at a 10-year high in August, exceeding the analysts’ expectations and posing a challenge for the European Central Bank (ECB). According to the preliminary data released by Eurostat on Thursday, the annual inflation rate was 5.3% in August, the same as in July. This was higher than the 5.1% forecast by a Dow Jones poll of economists. The inflation rate was also far above the ECB’s target of below but close to 2%. The main drivers of inflation were energy, food, and services prices, which rose by 15.4%, 2.7%, and 3.1% respectively. The core inflation rate, which excludes energy, food, alcohol, and tobacco, was 2.6% in August, up from 2.5% in July. The high inflation rate puts pressure on the ECB to consider tapering its massive stimulus program, which has been supporting the euro zone’s economic recovery from the pandemic. However, the ECB has repeatedly said that it expects the inflation spike to be temporary and that it will look through it until the medium-term outlook improves. The ECB will hold its next monetary policy meeting on September 9, where it will update its economic projections and discuss its policy stance.

The trade relationship between China and the U.S. deteriorated in the first half of the year, as the U.S. imposed tariffs and export controls on Chinese goods and technology. According to Xie Feng, China’s ambassador to the U.S., the bilateral trade volume dropped by 14.5% year on year in the first six months of 2021. He said that the U.S. measures were harmful to both countries and the global economy, and urged for a path to expand mutually beneficial economic cooperation and trade. He also criticized Biden’s executive order that restricts U.S. investments in Chinese companies that are involved in semiconductor and AI industries, calling it “a violation of the principle of free trade”. He said that China and the U.S. should respect each other’s core interests and avoid confrontation and conflict.

Stock markets ended slightly higher on Wednesday, building on the gains made earlier this week as volume weakened. The focus on job numbers and the implications of the data for the next Fed decision continues today. However, the Personal Income and Outlays data including the Core PCE which is the favorite number of the Fed for reading inflation can move the market substantially this morning. On the last trading day of August, plan for just about anything as investors deal with China, European, and Fed uncertainty contributing to the challenging price volatility while the so-called magnificent seven dominate the indexes.

Trade Wisely,

Doug

Comments are closed.