In Tuesday’s session, the SP-500 briefly breached the 3000 benchmark and the Dow topped 25,000. However, at the close of the day, there was a bit of uncertainty as to the bears defend these levels, and the tech sector left behind a bearish dark cloud cover pattern. The bulls squelched those closing concerns suggesting yet another overnight gap bringing the 2-day rally in Dow of more than 850 points just in the morning gaps! The question now is will there be follow-through buying or will it attract profit-takers and bears?

Asian markets closed mixed as US/China tensions grow. European markets, however, don’t seem at all concerned this morning with their indexes approaching 2% increases this morning. US futures point another substantial gap up open reaching well above yesterday’s high prints ahead of a light day on the economic calendar and earnings reports. Buckle up for another wild day in the market.

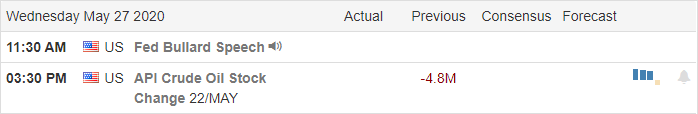

Economic Calendar

Earnings Calendar

On the Hump Day earnings calendar, we have 64 companies fessing up to quarterly results. Notable reports include UHAL, ADSK, BMO, BGFV, BOX, HPQ, NTAP, NTNX, RL, RY, TOL, VIPS & WDAY.

Technically Speaking

Yesterday’s gap up and run pulled back, leaving behind some concerning candle patterns; however, the futures once again point to a substantial gap up. The bullishness pushed the indexes through 3000, and the Dow breached 25,000 during the day. Although they failed to hold these levels into the close, today’s morning gap will recover the benchmark levels with a substantial cushion. According to the news reports, the bullishness is due to optimism about the economy reopening. Once again, it would seem possible the largest price move of the day may occur in the overnight session. Reports that COVID-19 related hospitalizations on the rise in several states continue to raise concerns about the second wave of infections. Yesterday’ the US death toll topped 100,000, but the only thing the market seems to be in infected with is a ravenous desire to buy risk overnight. Hum? The T2122 indicator continues to signal an over-extended condition, but on a positive, the Absolute Breadth Index finally broke through the downtrend. That would suggest we finally see a broader-based rally.

At the close yesterday, the QQQ left behind a bearish dark cloud cover pattern creating a little uncertainty as the trading day wound down. However, this morning the morning gap suggests a test of all-time highs in the tech sector remains viable. The SPY found itself unable to hold the 200-day moving average at the close yesterday, yet this morning we are gapping above yesterday’s high. Once again, traders could easily find themselves influenced to chase into the morning gap with the fear of missing out. Remember, big gaps can, at times, attract profit-takers and bring out the bears. Watch the price action closely after the open to make sure you see follow-though buying before jumping. Look before you leap, so to speak. If you have long positions with nice gains as I currently hold, it may be wise to bank some of the gains consider the Dow 2-day rally of about 850 points at the open today.

Trade Wisely,

Doug

Comments are closed.