Earnings reports move into high gear today with a big week of data that could easily create significant price volatility in the days ahead. With more than 100 company’s reporting, the beginning of the FOMC meeting, and the latest reading on Consumer Confidence, investors will have a lot to digest as we head into GOOGL and MSFT reports after the bell. A Wednesday morning gap is possible, but the question to be answered is up or down? Consider your risk carefully.

Asian markets traded mixed but mostly lower overnight though HSBC shares surged on earnings results. European markets currently see modest losses across the board as they monitor company reports and wait on the Fed. However, U.S. futures continue to move bullishly, suggesting a modestly higher open at the time of writing this report. Get ready for all the pops and drops earnings can create!

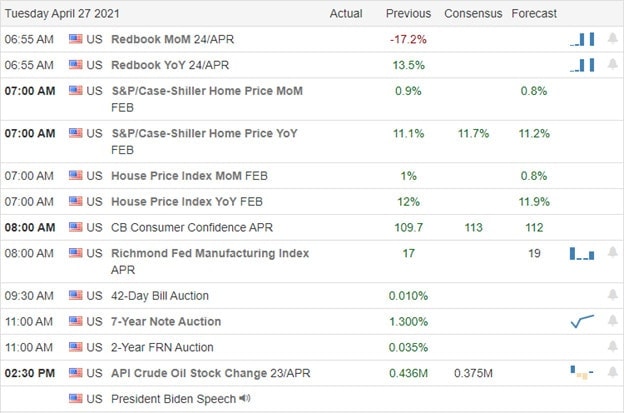

Economic Calendar

Earnings Calendar

The 2nd quarter earnings season kicks into high gear today, with more than 100 companies listed on the calendar. Notable reports include GOOGL, MSFT, MMM, ABB, AMD, AMGN, ADM, BP, COF, CNC, DB, GLW, CROX, ECL, LLY, EXX, FFIV, FEYE, FISV, GE, HAS, ILMN, IVZ, JBLU, JNPR, MDLZ, PINS, PHM, RTX, ROP, SHW, SBUX, SYK, TXN, UBS, UPS, V, WM, & YUMC.

News & Technicals’

As this big week of data rolls out, we had a bit of a mixed bag of results with the SPY and QQQ squeaked out new records, the DIA moved slightly lower in an essentially choppy price action day. Today begins the 2-day FOMC meeting with their decision announcement at 2 PM Eastern Wednesday. BP beats quarterly estimates and commits to a $500 million stock buyback in the second quarter. After the bell, TSLA reported better than expected results; however, the stock is indicated modestly lower this morning. Rep. Richard Neal will introduce legislation that would provide Universal paid family and medical leave of up to 12 weeks and make permanent the tax credits provided in Biden’s Covid relief package. The President issued yet another executive order raising the federal contractor minimum wage to $15 an hour. Treasury yields pushed higher this morning, with the 10-year advancing to 1.581% and the 30-year rising to 2.258%.

Bullish trends remain strong earnings ramp-up to a fevered pitch, and we wait on the FOMC decision. All eyes will be on the tech giants GOOGL and MSFT after the bell today. Can they produce results to support current prices with P/E Ratios already near 30 and above? We will find out later today! Until then, we have a significant day of company reports and economic data to digest. However, after the burst of morning activity, don’t be too surprised if price action becomes light and choppy as we wait in anticipation of the tech reports. Plan for the possibility of a substantial gap up or down Wednesday morning, depending on the tech results, and plan your risk accordingly heading into the close of the day. Interestingly, as the SPY and QQQ crept higher, so did the VIX, with a very unimpressive performance in the market breadth indicator.

Trade Wisely,

Doug

Comments are closed.