Facing a big day of earnings and economic data while digesting more new records in daily infections and deaths, the US Futures point to the gap down open. While it was nice to see some follow-through bullishness yesterday, the elevated VIX continues to show the market uncertainty and adds significant complexity for traders as they try to navigate the wild price swings. Today is likely to be no different with gaps and intraday reversals as the market attempts to digest all the data.

Asian markets close the day seeing only red across the board as the tensions between the US and China rise. European markets are also trading lower this morning as virus concerns weigh heavily on investors. US Futures point to a lower open this morning, reacting to early earnings data and rising pandemic impacts.

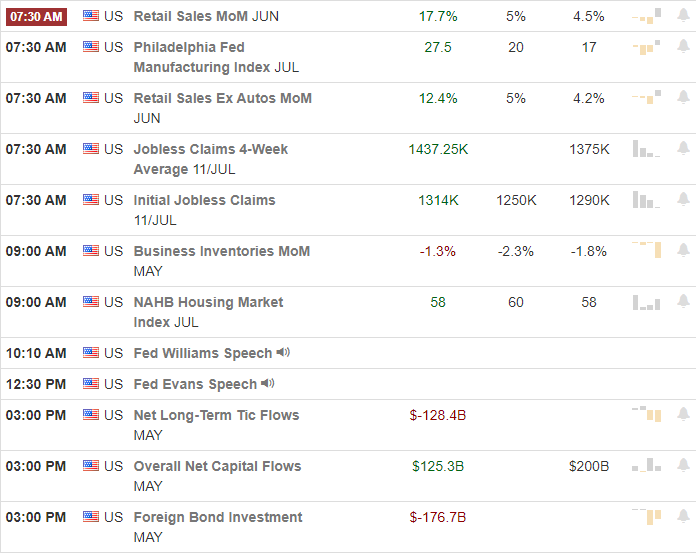

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have 37 companies reporting their quarterly results. Notable reports include JNJ, NFLX, ABT, BAC, SCHW, DPZ, JBHT, MS, PPG, TSM, & TFC.

News and Technical’s

With daily reversals and big point moves as this morning begins, it looks like the market is shaping up to give us more of the same. Sadly we seem to be losing the battle on the virus front hit a new national record of daily infections as well as a new daily record death toll. Several state now requiring the wearing of masks in public while some profoundly affected states want to soldier on without additional measures. The pandemic is putting a strain on the healthcare system in several states filling their hospitals to near capacity. Today we will get earnings reports BAC and MS and NFLX. Although very early in the season, the results have been a mixed bag. We also have our biggest day of the week on the economic calendar, which includes Jobless Claims and Retail Sales numbers as if there is not already a lot for the market to digest.

Yesterday’s big gap up was an excellent follow-through to Tuesday’s rally but ended the day rather unconfidently. The DIA tested the resistance of the Island Reversal pattern established in early June, but the bears held their ground by the close. The SPY easily broke above its island reversal pattern holding it solidly into the close while the QQQ struggled with a lackluster performance with several of the big tech giants finding some profit-takers. IWM benefited from the rally in the financials after the GS earnings report finally breaking above and holding its 200-day moving average by the close. With a big day of data, the US Futures currently point to a gap down open. The VIX, although pulling back yesterday, continues to hold above its 200-day average holding on to an elevated close above 27 handles. With so much data coming our way, anything is possible, so plan carefully and remain flexible.

Trade Wisely,

Doug

Comments are closed.