Early morning bearishness quickly turned to a choppy morning session that rather suddenly rocketed up in a big afternoon surge with rather low volume. DIA, SPY, and QQQ all closed at new record highs as traders showed tremendous confidence heading into big tech reports and an FOMC decision. After the bell, we will get the highly anticipated reports from MSFT, GOOGL, and AMD. Plan for a substantial gap Wednesday morning as a result so plan your risk accordingly also keeping in mind the pending FOMC decision. Buckle up for some potentially wild and challenging price action.

Overnight Asian markets closed mixed but mostly lower with Hong Kong and Shanghai leading the selling in reaction to the Evergrande liquidation order adding more uncertainty to China’s real-estate decline. However, across the pond, the European markets are green across the board this morning celebrating a stagnating GDP instead of slipping into recession. U.S. futures point to a slightly bearish open ahead of big tech reports and pending rate decisions on the horizon.

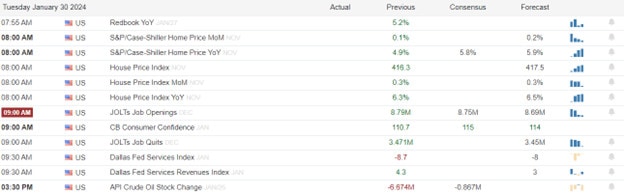

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include GOOGL, MSFT, AOS, AMD, ASH, BXP, CCJ, CB, GLW, DHR, EA, EQR, GM, HA, HCA, HUBB, JBLU, JCI, JNPR, LC, LFUS, MOD, MDLZ, MPLX, MSCI, PNR, PFE, PHM, SWKS, SBUX, SYK, SYY, TECK, TER, UNUM, UPS.

News & Technicals’

The Big Tech companies are in the spotlight, as they reveal their earnings for the latest quarter. Microsoft and Alphabet will announce their results on Tuesday after the bell, while Meta Platforms, Apple, and Amazon will follow on Thursday. Investors are expecting robust performance from these behemoths, which boosted their share prices to new highs on Monday. The rally in Big Tech lifted the S&P 500 to a new record – and its first close above 4,900. The Dow Jones Industrial Average also reached a new peak at the end of the day.

The eurozone economy showed signs of resilience in the last quarter of 2023, according to the preliminary data released by the EU’s statistical office on Tuesday. The bloc managed to dodge the mild recession that was predicted by a Reuters survey of economists after its GDP shrank by 0.1% in the third quarter. The euro zone’s GDP, adjusted for seasonal variations, did not change from the previous quarter and grew by a meager 0.1% from a year ago.

Neuralink, the brain-computer interface company founded by Elon Musk, announced that it had successfully implanted its device in a human for the first time on Sunday. The patient, whose identity was not disclosed, is “doing well” after the surgery, according to a post on X, a social media platform for scientists and researchers. Neuralink started enrolling patients for its first human trial in the fall, after getting the green light from the FDA in May. The trial is part of Neuralink’s ambitious goal to bring its technology to the market and enable people to control computers and machines with their minds.

Reed Hastings, the co-founder and executive chairman of Netflix, has donated two million shares of the online video service, as per a regulatory filing. The shares are worth more than $1.1 billion at the current market price. Hastings, who has a net worth of $6.6 billion, according to the Bloomberg Billionaires Index, holds a large stake in Netflix, which he helped create in 1997.

With a big afternoon surge the DIA, SPY, and QQQ closed at new record highs, ahead of a hectic week for the macro economy. The Russell 2000 index, worked to catch up action and was the best performer, gaining about 1.4% on the day. The NASDAQ, of course, also did well, increasing by more than 1% as the tech titans continued to stretch higher in anticipation of earnings. Will their earning support these lofty valuations? We will soon find out. Today the FOMC will begin deliberations on interest rates and we will get their decision Wednesday afternoon at 2:00 Eastern. After the bell today we will also get the highly anticipated earnings reports from GOOGL, MSFT, and AMD. The results could create considerable price volatility on Wednesday including a substantial morning gap so plan your risk carefully my friends.

Trade Wisely,

Doug

Comments are closed.