The market appears stuck between a rock and a hard place as talk of an economic slowdown, political uncertainty both domestic and abroad, and earnings season unfolds. Indexes dance between significant levels of price resistance and current short-term trend supports waiting for the event that will determine direction. While I believe it’s very healthy that the markets are consolidating all the outside influences means traders will have stay on their toes and prepared for just about anything.

Be cautious about over-committing to a directional bias as we chop around in this tight price action range. Just one event could change direction, and unfortunately, that could easily happen overnight. Yesterday’s whipsaw price action should serve as a reminder of a nervous market and how quickly sentiment can shift.

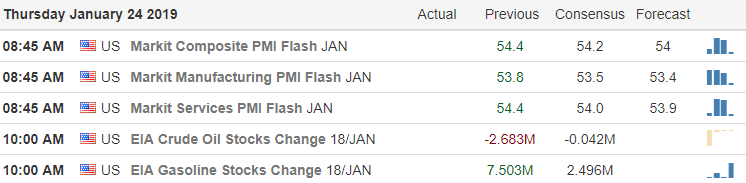

On the Calendar

On the Earnings Calendar, we have the biggest day this week with 125 companies reporting results. Notable earnings: ISRG, ALK, BMY, DFS, ETFC, FCX, HBAN, INTC, JBLU, MKC, NSC, RCI, LUV, SBUX, UNP, GWW, WDC.

Action Plan

There was more conversation from IMF’s Lagarde about an economic slowdown overnight with China as the point of concern. As a result, we see muted and mixed markets around the world. As I write this US Futures, suggest a flat open, but I suspect that could change dramatically as the morning earnings results roll out. Two bills to end the government shutdown mover forward to a today but both are currently expected to fail. That’s really not important, but the heightened political spin leading up to the vote and the aftermath could certainly affect the market attitude.

As of now the Bulls and Bears appear deadlock with the indexes slipping into a consolidation range. Personally, I think this rest is healthy for the market as we build a level of price action support just above the 50-day moving averages. Unfortunately, with all the political uncertainty, economic slowdown talk and earnings results just one event could substantially change market sentiment. That could mean a fast move up or a fast move down, and traders should prepare for the possibility of either. A directional over-commitment could be a mistake as we continue to dance between support and resistance levels.

Trade Wisely,

Doug

Comments are closed.