The bulls are in beast mode this morning after the US and China agreed to a cease-fire and agreed to resume negotiations. Looking at the futures this morning one might assume the tariff war is over but as of now there is still no clear path to a deal and current tariffs will remain in place. The good news is there was no escalation in the rift between the countries.

Asian markets closed mixed but mostly higher on the G20 developments and European markets are currently sharply higher this morning. US Futures currently indicate a soaring gap up that will likely set new record highs and punish any traders caught short. Keep in mind with the market closing early Wednesday for the holiday volume will likely begin to decline sharply over the next 2-days as traders head out to celebrate. It is entirely possible the biggest price move of the day will be the gap so be careful not to chase.

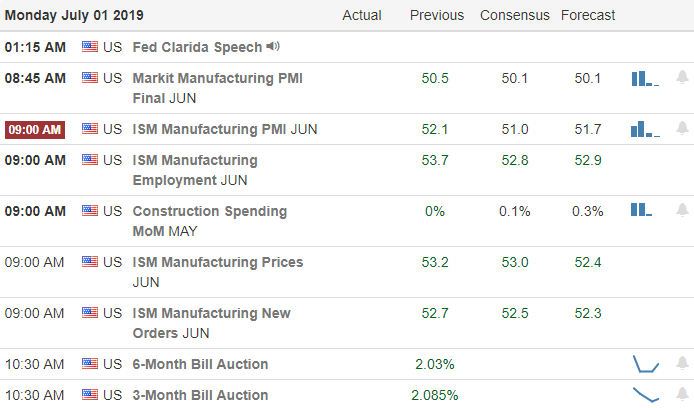

On the Calendar

On Monday’s Earnings Calendar we have 14 companies reporting results but none are particularly notable.

Action Plan

Tariffs remain in place but the US and China have agreed to come back to the negotiations table. The President also agreed to ease restrictions American companies from selling products to Huawei. Chetan Ahya, global head of economics describes the meeting results as “an uncertain pause”, with no clear path to a deal. However, the bulls are celebrating the meeting results of the meeting this morning and the futures are flying high.

I would expect new record highs this morning and anyone caught short will likely be squeezed out this morning. Unfortunately the biggest price move of the day may be the gap so be very careful not to get caught up in the excitement and chase into the open. Let’s keep in mind that the market will close early on Wednesday in observation of the 4th of July holiday. That means volume is likely to begin dropping as traders head out early to celebrate.

Trade Wisely,

Doug

Comments are closed.