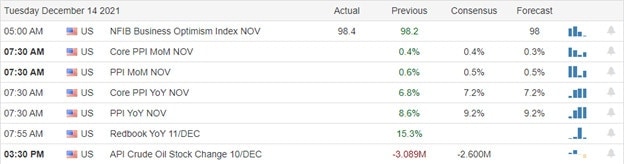

The SPY could not hold onto Friday’s record as the bears returned to work, creating minor technical damage in the QQQ and raising uncertainty with bearish candle patterns left behind. In addition, concerns of economic impacts from the rapidly spreading variant dinted investor sentiment. Today we will turn our attention to the pending PPI report and the beginning of the FOMC meeting. If the inflation numbers come in hot will, we again choose to ignore? If we don’t get a significant reaction from the PPI, then look for choppy market conditions as we wait on the FOMC decision Wednesday afternoon.

Overnight Asian markets worried about potential impacts of the new variant closed in the red across the board with led by Hong Kong falling 1.33%. This morning, European markets trade mixed and muted, keeping an eye on rising pandemic infection rates and central bank decisions. With a light day of earnings and key inflation data just around the corner, U.S. futures point to mixed open with a notable gap down forming in tech before the data.

Economic Calendar

Earnings Calendar

We have just 15 companies listed on the Tuesday earnings calendar, with several unconfirmed. Notable reports include ASPU & CLSK.

News & Technicals’

The report said that the recovery to be affected by a new surge in Covid-19 cases, with jet fuel getting hit hard. In addition, its authors noted that the emergence of the new omicron variant had already brought about new restrictions on international travel. Toyota, one of the world’s largest automakers, is planning to invest 4 trillion yen ($35 billion) to build a full lineup of 30 battery-powered electric vehicles by 2030. It aims to increase global sales of battery electric vehicles by 3.5 million units a year by 2030. Most of Toyota’s current electric vehicle sales are hybrid EVs powered by an internal combustion engine and battery-operated electric motors. ACCORDING TO FINANCIAL FILINGS OUT LATE MONDAY, Tesla CEO Elon Musk sold another 934,091 shares of his electric car company, which are worth around $906.49 million. Musk also exercised options to buy 2.134 million shares of Tesla at the strike price of $6.24 per share granted to him via a 2012 compensation package. Musk, the wealthiest person globally and was just named Time Magazine’s 2021 Person of the Year, still has millions of stock options that he needs to exercise by August 2022. Treasury yields tick higher in early Tuesday trading, with the 10-year trading up to 1.4326% and the 30-year inching higher to 1.8145%.

The bears returned to work on Monday; the rapidly spreading variant fears of economic impacts grow. Adding to the uncertainty, another key inflation PPI report and the beginning of the FOMC meeting may double the amount of taper and signal rate increases possible in 2022. The DIA left behind an evening star pattern at price resistance but managed to hold current support levels. The SPY could not hold onto Friday’s record falling back into a consolidation zone holding just above support. Finally, the QQQ suffered technical damage in the Monday selling, breaking support and falling into the huge gap left behind on December 7th. IWM remains the weakest of the indexes nearing a retest of the December 1st low. The question for today is, will the bulls find the energy or inspiration to defend, or will the bears gain the edge? Last Friday, the market chose to ignore the surging inflation. Can they do the same today if the PPI number comes in hot? We will soon find out. So, buckle up and prepare for another dose of price volatility.

Trade Wisely,

Doug

Comments are closed.