Though the Dow benefited from MSFT and BA the bears remained resilient attacking the tech sector with the so-called magnificent seven leading the way lower. Bond yields edged higher and unfortunately continue to do so this morning facing a huge day of earnings as well as a busy economic calendar chalked full of market-moving reports. Indexes remain in a short-term extreme oversold condition that suggests a relief rally could begin at any time but if the data continues to pile on panic selling is possible to break recent market lows. Plan for signalment price volatility!

Overnight Asian markets closed mostly lower with only the Shanghai index managing a 0.14% gain as Australia shares close at a one-year low. European markets are lower across the board this morning in reaction to earnings and the likelihood the ECB will hold rates steady. U.S. futures also suggest a bearish open led by the tech sector ahead of a huge day of earnings and economic reports that could move the market substantially. Buckle up for a potentially wild day of volatility as the investors react.

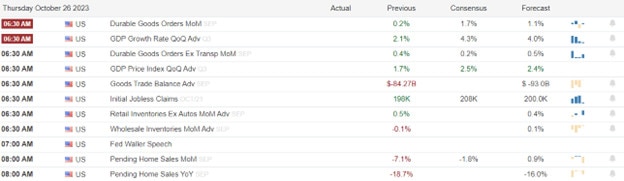

Economic Calendar

Earnings Calendar

Notable reports for Thursday include AMZN, AOS, AB, MO, AMT, AIT, ARCH, BJRI, SAM, BSX, BC, BG, CPT, COF, CSL CARR, CNP, CMS, CC, CMG, CINF, COLM, CMCSA, COUR, CFR, DECK, DXCM, DLR, EMN, EHC, ENPH, ESS, FAF, FHI, FE, F, FGLI, GWW, HOG, HIG, HAS, HSY, HTZ, HON, HUBG, INTC, IP, JNPR, KVUE, KDP, KIM, LHX, LH, LII, LIN, MAS, MA, MPW, MRK, MBLY, MHK, NRDS, NEM, NOC, NVCR, OLN, OSTK, BTU, PCG, PFG, PTCT, RS, RSG, RCL, STX, SKYW, LUV, STAG, STM, TEX, TXRH, TXT, TSCO, TW, TSCO, TW, TPH, UPS, X, UDR, VLO, VRSN, VMC, WTW, and WY.

News & Technicals’

Mercedes-Benz, the German luxury carmaker, reported lower profit and revenue for the third quarter of 2021, as it faced tough competition in the electric vehicle (EV) market. The company’s Chief Financial Officer, Harald Wilhelm, said that the EV market was a “pretty brutal space,” according to Reuters. He said that some traditional automakers were selling EVs at a loss, despite their higher production costs, to gain market share. This put pressure on Mercedes-Benz’s pricing and margins, as it tried to balance profitability and growth. The company’s shares fell by 2.6% on Thursday, as investors were disappointed by its results.

The U.S. economy may have performed well in the third quarter of 2021, but one strategist warns that the U.S. consumer, a key driver of the economy, is facing a looming crisis. Chris Watling, the chief executive of Longview Economics, a financial advisory firm, told CNBC’s “Squawk Box Europe” that the U.S. consumer is “walking towards a cliff.” He said that consumer spending, which has been boosted by stimulus checks and pent-up demand, is unsustainable and will soon run out of steam. He also said that the rising inflation, supply chain disruptions, and labor shortages will hurt consumer confidence and purchasing power. He predicted that the U.S. economy will slow down significantly in 2022 and 2023, as consumer spending weakens.

The commercial real estate markets in the U.S. and China are facing challenges in a scenario where interest rates remain high for a long time, according to Singapore’s United Overseas Bank (UOB). The bank said that higher rates could affect the demand and supply of commercial properties, as well as the financing and valuation of these assets. However, the bank also expressed optimism about one key region: Southeast Asia. The bank said that Southeast Asia has attracted strong investment flows, especially in the new economy sectors such as sustainability. The bank cited examples of green buildings, renewable energy projects, and digital infrastructure that have received funding from both domestic and foreign investors. The bank said that Southeast Asia offers attractive opportunities for commercial real estate investors, as the region has a large and growing population, a rising middle class, and a supportive policy environment.

Hints of a selling relief gave way to more selling Wednesday as the bears remained resilient, reacting to the earnings reports and the rising bond yields. The technology sector suffered the most as the so-called magnificent seven lost some of their shine. The Dow did better, thanks to the strong performance of Microsoft and Boeing shares. Interest rates remain the main factor for the financial markets. Ten-year Treasury yields rose again on Wednesday, going back over 4.9% but still below the recent highs after reaching 5% on Monday. Today we have a huge day of earnings with AMZN in focus after the bell. We also have market-moving economic reports that include Durable Goods, GDP, International Trade, Jobless Claims, Pending Home Sales, as well as more Fed speak and bond auctions to keep traders guessing and volatility high. Fasten your seat belts folks its likely to be a bummy day as we test recent lows in a very oversold short-term condition.

Trade Wisely,

Doug

Comments are closed.