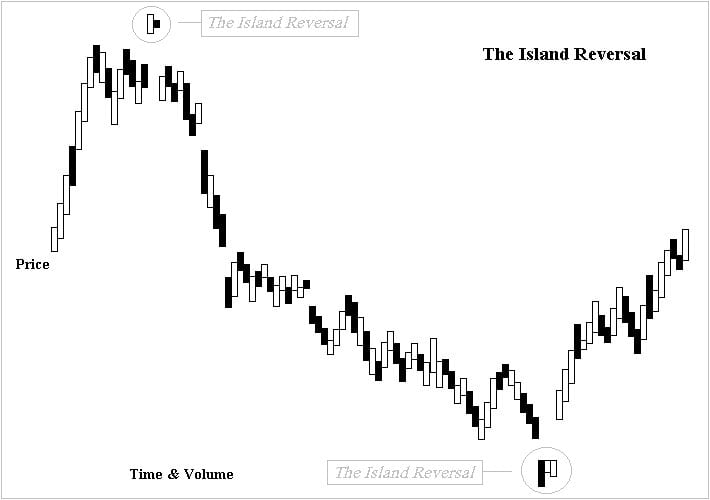

No man is an island (according to John Dunne, that is), but some candlestick patterns are. Separated from the rest of the price action, completely broken off and drifting, a Bearish Island Reversal pattern is a gap up in a bull trend. When the signal finally gaps back down and enters the price action again, the trend reverses and becomes bearish. This may not be an island in the sun, but it’s certainly worthy of your attention. To help you spot this Island Reversal on the map, let’s discuss its landmarks (i.e., what it looks like) and its impact on the environment (i.e., what it means for traders).

Bearish Island Reversal

Formation

The Bearish Island Reversal is unique in that it jumps away from the price action somewhat dramatically. Although this allows for easy identification, it is still important to review how to identify the Bearish Island Reversal. To spot it, look for the following criteria:

First, a clear uptrend must be in progress. Second, the price must gap up, creating an unfilled space in which no trading takes place. So the candle’s low will be above the high of the previous day. Third, that same candle must then gap back down, creating another unfilled space, which should overlap with the first gap. So its low must also be above the next day’s close. Finally, to confirm the pattern, look for the start of a downtrend after the gap down.

In addition, an Island Reversal is not restricted to a single candlestick. If there are several candles in between the gap up and gap down, an Island Cluster is formed.

Meaning

A Bearish Island Reversal begins with a typical uptrend. The bulls are in control, and the price gaps upward. It remains high for a day or several days. However, following this positive jump, there is an extreme change in market sentiment, causing a gap down and a downtrend. The sharp and sudden change may be prompted by a current event or news story that occurs before the market opens or after it closes.

A Bearish Island Reversal is most reliable if it occurs after a strong uptrend. The weaker the uptrend, the weaker the signal. In addition, this pattern is more dependable if the gaps (both up and down) are large. When you combine a powerful uptrend with tall gaps, the change in sentiment is both very impressive and very trustworthy.

_____

Even if you’re a great explorer of candlestick charts, you may never come across an Island Reversal. They are rare, but they are also reliable indicators of reversals on the horizon. Despite the Bearish Island Reversal’s consistent performance history, however, we always recommend that you check for confirmation before you make your move. Good luck!

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.