Stock futures remained relatively unchanged early Thursday, with Wall Street approaching new record highs. This stability in futures followed a Wednesday session where the S&P 500 reached an intraday record high. The stock market’s positive momentum is being driven by optimism surrounding potential tax cuts and deregulation under President Donald Trump, along with indications of robust economic growth. Investors are also anticipating updated economic data, with initial jobless claims set to be released before the market opens, followed by Kansas City Fed manufacturing data later in the day.

European stocks opened with mixed results on Thursday, following a week of positive momentum. Sportswear brand Puma experienced a significant drop, with shares falling by 19% in early trading after missing full-year 2024 profit expectations and announcing cost-cutting measures. This contrasted sharply with competitor Adidas, which reported 19% growth in fourth-quarter top-line figures earlier in the week.

Asia-Pacific markets showed mixed performance on Thursday. Hong Kong’s Hang Seng index declined by 0.65%, while China’s CSI 300 saw a gain of 1.01%. To support the struggling stock market, Chinese financial regulators urged large state-owned mutual funds and insurers to increase their share purchases. Australia’s S&P/ASX 200 rose by 0.61%, whereas South Korea’s Kospi and Kosdaq fell by 1.24% and 1.13%, respectively. Japan’s Nikkei 225 and Topix indices both experienced gains, with the Nikkei 225 up by 0.79% and the Topix by 0.53%. Meanwhile, the Bank of Japan is holding a policy meeting, where Governor Kazuo Ueda has indicated a potential rate hike.

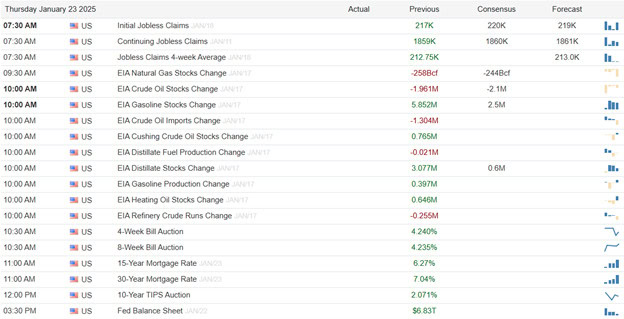

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell include ALK, AAL, AUB, BANC, ELV, FBP, FSV, FCX, CATX, GE, MCK, NTRS, PPBI, RCI, TECK, TCBI, UNP, VLY, & WNS. After the bell reports include ASB, COLB, CSX, CUBI, EWBC, FFBC, GBCI, ISRG, SLM, SSB, & TXN.

News & Technicals’

Warner Bros. Discovery’s CNN is set to lay off hundreds of employees on Thursday as it shifts its focus towards a global digital audience. This move comes as CNN restructures its linear TV lineup and expands its digital subscription offerings. The layoffs aim to reduce production costs and streamline teams, according to sources who requested anonymity. Similarly, NBC News is also planning job cuts later this week, although the exact number remains unclear. Both organizations delayed these decisions until after the U.S. presidential inauguration. The media landscape is evolving, with fewer viewers tuning into linear TV and more people consuming news via streaming services and social media.

Microsoft’s head of business development, Chris Young, is resigning after approximately four years in the role, as disclosed in a regulatory filing on Wednesday. Young played a key role in orchestrating Microsoft’s acquisition of Activision Blizzard and was a member of the senior leadership team, reporting directly to CEO Satya Nadella. Despite no successor being named yet, Young’s departure marks a significant change in the company’s leadership. In the 2024 fiscal year, he was one of Microsoft’s highest-paid employees, earning total compensation of $12 million.

In the third quarter of 2024, the proportion of active credit card holders making only minimum payments reached a record high of 10.75%, the highest since data collection began in 2012. Additionally, the share of cardholders more than 30 days past due increased to 3.52%, up from 3.21%, marking a rise of over 10%. Despite this uptick in delinquency rates, the current level remains significantly lower than the 6.8% peak observed during the 2008-09 financial crisis, suggesting that the situation has not yet reached critical levels.

The U.K. Competition and Markets Authority (CMA) has announced dual investigations into Apple and Google to determine if they possess “strategic market status” within their mobile ecosystems. These ecosystems encompass the operating systems, app stores, and smartphone-based browsers that form the foundation of the two tech giants’ software. The probes are being conducted under the new Digital Markets, Competition and Consumers Act (DMCC), a U.K. law aimed at curbing anti-competitive practices in digital markets.

Though we are approaching new record highs and market enthusiasm is raging, keep in mind the extension that very high valuations in stock prices. If selling were to begin, we could easily see some quick piling on as traders rush to the door to protect profits. That said, with record highs so close I would not rule out a strong push to get the new high for the record book before a pull back begins. Plan your trading risk carefully.

Trade Wisely,

Doug

Comments are closed.