Traders and investors are dealing with a mix of anticipation and Unertainty with post-market earnings announcements from Amazon, Advanced Micro Devices, and Starbucks garnering significant attention. At the same time there is a palpable uncertainty surrounding the Wednesday FOMC and the possible hawkish tone and higher for longer statemets as the inflation fight continues

During the night, Asian markets mostly upticked on Tuesday, mirroring the trends set by Wall Street. Investors’ attention was particularly focused on the April manufacturing purchasing managers’ index (PMI) from China. The latest data revealed that China’s manufacturing sector grew at a reduced rate in April, with the official PMI registering at 50.4, a slight decrease from March’s 50.8.

European trade mixed and lower this morning, marked by the release of numerous earnings reports and critical economic indicators. Most industry sectors experienced a minor downturn, with, the euro zone’s inflation rate unchanged at 2.4% in April. The core inflation rate, which excludes volatile items such as energy, food, alcohol, and tobacco, was reported at 2.7%.

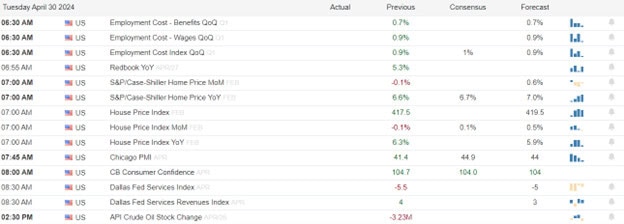

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include MMM, ACIW, APD, AEP, AMT, ADM, AWI, ATI, EAT, CNP, CO, GLW, DAN, ETN, ECL, LLY, EPD, ETRN, FELE, IT, GEHC, GPK, HRMY, HUBB, ITW, INCY, LEA, MAC, MPC, MLM, MCD, TAP, MPLX, NOG, OCSL, OMF, PACR, PYPL, PAG, PEG, SIRI, SYY, SMHC, TT, UFPI, & ZBRA. After the bell reports include AMZN, AMD, ASH, AX, BLKB, BXP, CZR, CHK, CLX, DENN, FANG, DBRG, EIX, EQH, ESS, EXEL, EXR, GPOR, HI, HURN, INVH, LEG, LMND, LC, LFUS, LPLA, LUMN, MATX, MIR, MDLZ, OI, OKE, PK, PDM, PINS, POWL, PRU, PSA, RSG, SWKS, STAG, SBUX, SYK, SMCI, SKT, UDR, UNM, VOYA, WPC, & WERN.

News & Technicals’

McDonald’s disclosed mixed financial outcomes. The fast-food giant reported a modest surpass on revenue, indicating a resilient performance in sales. However, the earnings per share (EPS) fell marginally short of market expectations, reflecting some underlying challenges. In the U.S., McDonald’s observed a downturn in expenditure among low-income consumers, signaling economic pressures that could affect the company’s domestic market share. Internationally, the brand contended with boycotts sparked by its Israeli licensee’s promotional offers to soldiers, leading to a temporary shutdown of several outlets. This controversy has notably impacted McDonald’s sales in the Middle East, adding to the complexities of operating a global franchise amid varying geopolitical climates.

Walmart has announced a significant shift in strategy, revealing plans to shut down all of its healthcare clinics nationwide. This move marks a departure from its previous ambitions to extend its affordability ethos to medical services, alongside its traditional retail offerings. Additionally, the retail giant is set to close its telehealth service, which was acquired in 2021 for an undisclosed sum. Citing the inability to sustain a profitable healthcare business model, Walmart pointed to the difficult reimbursement landscape and escalating expenses as the primary reasons for this decision. This development represents a notable retreat from the company’s healthcare venture, underscoring the complexities of the healthcare industry.

Volkswagen’s first-quarter financials have signaled a challenging period for the automotive giant, with a 20% decline in operating profit. This downturn is attributed to a faltering demand for its high-end vehicle lines. The total vehicle sales stood at 2.1 million units, marking a slight decrease of approximately 2% from the previous year. The impact was more pronounced in Volkswagen’s luxury division, Porsche, which experienced a steep 30% fall in operating profit. Concurrently, the global car manufacturer Stellantis also faced economic headwinds, reporting a 12% drop in revenue. Stellantis attributes this decline to diminished sales volumes and the adverse effects of foreign exchange rates, despite maintaining stable net pricing. These reports from Volkswagen and Stellantis reflect the broader challenges faced by the auto industry, including shifting consumer preferences and economic pressures.

In a pivotal moment for the cryptocurrency industry, U.S. District Judge Richard Jones is set to deliver a sentence to the founder and former CEO of Binance, Changpeng Zhao, in a Seattle court on Tuesday. This sentencing follows Zhao’s guilty plea to criminal charges last November, an admission that led to his resignation from the helm of the world’s largest crypto exchange. The decision by Judge Jones comes after months of deliberation over the suitable penalty for Zhao’s actions, which have had significant repercussions within the crypto community and beyond. The outcome of this sentencing is highly anticipated, as it could set a precedent for how legal systems around the world handle similar cases in the rapidly evolving digital currency landscape.

Plan for considerable price volatility as the market deals with anticipation and uncertainty of pending big tech reports with the looming FOMC decision. Keep a close eye on overhead resistance levels and of course the bond yields that continue to trend upward as the inflation battle continues.

Trade Wisely,

Doug

Comments are closed.