Stock futures edged slightly higher on Thursday as investors anticipated upcoming remarks from Federal Reserve Chair Jerome Powell later in the week. The positive sentiment was reflected in the performance of major indices, with the S&P 500 and the Nasdaq Composite each marking their ninth winning session out of the last ten. The S&P 500’s recent gains brought it to within less than 1% of its all-time closing high.

The pan-European Stoxx 600 index saw an overall increase, with most sectors showing positive performance. Retail stocks led the gains with a 1.36% rise, while mining stocks experienced a slight decline of 0.69%. Fresh purchasing managers index data indicated robust business activity in both the U.K. and the euro zone for August. Among individual stocks, Swiss Re’s shares climbed by 3.11%, whereas Aegon shares dropped by 5.71% following the announcement of a net loss of 65 million euros.

Asia-Pacific markets experienced a positive trend on Thursday, driven by investor reactions to business activity data from Australia and Japan. The anticipation of PMI numbers from India also played a role in market movements. In South Korea, the Bank of Korea maintained its benchmark interest rate at 3.5%, aligning with market expectations. This decision, coupled with the business activity data, contributed to the overall optimistic sentiment in the region.

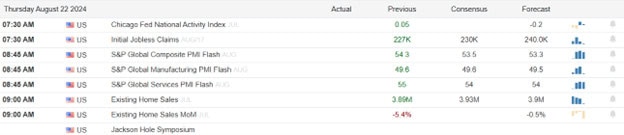

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell include AAP, BILI, BJ, CSIQ, LANC, PTON, TD, VIK, & WB. After the bell include ALC, BILL, CAVA, INTU, ROST, WDAY.

News & Technicals’

Canadian Pacific Kansas City (CPKC) halted their rail networks across the country on Thursday, locking out nearly 10,000 workers following unsuccessful negotiations with a major labor union. This decision, confirmed by the Teamsters union, paves the way for an unprecedented rail stoppage that could severely impact the Canadian economy and significantly affect cross-border trade with the United States. The shutdown underscores the critical role of rail transport in both national and international commerce, highlighting the potential economic repercussions of prolonged labor disputes.

In 2024, the phenomenon of “ghost jobs” has become increasingly prevalent, with four out of ten companies posting fake job listings and three out of ten currently advertising for non-existent roles. This trend highlights a significant shift in hiring practices over the past five years. According to Revelio Labs, a U.S.-based workforce intelligence company, the rate of hires per job posting has dramatically decreased. In 2019, there were eight hires for every ten job postings, but by 2024, this number had dropped to just four hires per ten job postings.

China’s state media and foreign ministry swiftly criticized Washington following a New York Times report that U.S. President Joe Biden had adjusted the U.S. nuclear strategic plan to address Beijing’s rapid nuclear arsenal expansion. Despite these claims, the White House clarified that the strategic plan was not aimed at any specific country or threat. This development has heightened tensions between the two nations, reflecting the ongoing complexities in U.S.-China relations.

In a recent interview with CNBC’s Jim Cramer, Snowflake CEO Sridhar Ramaswamy addressed the cyber-attack the company experienced earlier this year, emphasizing that it has not impacted their business operations. Ramaswamy reassured that the headlines surrounding the incident have not affected their core business with either existing or new customers. He highlighted that while discussions about security have increased to ensure customer safety, the core Snowflake platform remains robust and secure. This confidence underscores Snowflake’s commitment to maintaining high security standards and customer trust.

After the 818,000 jobs revision, the highly anticipated upcoming remarks from Jerome Powell at 10AM eastern Friday, likely makes today a hurry up wait day filled with choppy price action. That said we will have to pay attention to the jobless claims number as the market may have some sensitivity to it due the huge revision yesterday.

Trade Wisely,

Doug

Comments are closed.