U.S. stock futures were pointing higher on Wednesday morning, offering yet another premarket pump after a tough Tuesday. The previous session saw a decline across major averages, triggered by stronger-than-anticipated growth in the U.S. services sector. The Institute for Supply Management’s services index for December revealed a significant acceleration in activity, accompanied by a concerning rise in prices. These fueled fears of persistent inflation, casting doubt on the anticipated path of interest rate cuts by the Federal Reserve. Market attention now shifts to the upcoming release of the ADP private payrolls report and jobless claims data, both scheduled for Wednesday morning. Later in the day, the minutes from the Fed’s December meeting are expected to provide further insights into the central bank’s policy outlook.

European markets displayed resilience on Wednesday morning, trading higher despite disappointing news. German industrial orders unexpectedly fell in November, initially causing some market jitters, particularly in the auto sector. However, the broader market sentiment remained positive, with most sectors experiencing gains. Notably, financial services stocks saw a significant increase of almost 1%. The auto sector, after an initial dip, recovered and was trading 0.3% higher later in the morning. Market participants are now eagerly awaiting the release of European consumer confidence and economic sentiment data later in the day, which could further influence market direction.

Asia-Pacific markets experienced mixed trading on Wednesday. The Hang Seng Index fell by 0.83%, and mainland China’s CSI 300 closed 0.18% lower. The Chinese onshore yuan reached a 16-month low of 7.3316 against the US dollar. In Japan, the Nikkei 225 dipped 0.26%, and the Topix lost 0.59%. Conversely, South Korea’s Kospi rose by 1.16%, and the Kosdaq Index increased by 0.19%. Notably, shares of South Korean tech giant Samsung Electronics surged 3.43% despite a worse-than-expected profit forecast for the fourth quarter.

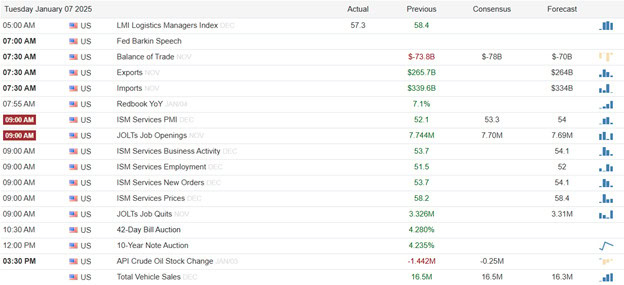

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include AYI, ACI, ANGO, HELE, MSN, RDUS, & UNF. After the bell reports include GBX, JEF, & PENG.

News & Technicals’

U.S. Treasury yields remained largely unchanged in early Wednesday trading as investors braced for key economic data releases. The benchmark 10-year Treasury yield held steady near its highest level in over eight months, reached on Tuesday. The 2-year Treasury yield also saw minimal movement. Market participants are keenly awaiting the release of the Federal Reserve’s December meeting minutes at 2 p.m. ET, particularly for insights into the central bank’s future policy direction, especially after the unexpected hawkishness displayed in the “dot plot” during their last meeting. Additionally, the ADP private payrolls report, scheduled for release later in the morning, is expected to provide a preview of the official jobs report from the Bureau of Labor Statistics due out on Friday.

Ann Altman, sister of OpenAI CEO Sam Altman, has filed a lawsuit alleging sexual abuse by her brother between 1997 and 2006. The lawsuit claims the abuse caused severe emotional distress and mental anguish. In a joint statement, Sam Altman, his mother, and his brothers denied the allegations.

The aviation industry faces another challenging year with Boeing’s delivery delays and persistent supply chain issues. The anniversary of a 737 Max incident, where a door panel detached, has reignited concerns about Boeing’s safety and quality standards. While Boeing has implemented changes like mandatory training and increased inspections, aviation consultant Mike Boyd argues these measures are insufficient. He believes the entire board of directors should have been replaced, highlighting the deep-rooted nature of the company’s problems.

China’s onshore yuan hit a 16-month low against the dollar on Wednesday, reaching as low as 7.3316. This decline coincides with rising Treasury yields, which strengthened the dollar. Despite China’s efforts to boost consumption through updated policies, the yuan has weakened for five of the past six trading days, depreciating over 0.44% since December 31st.

Trade Wisely,

Doug

Comments are closed.