Another day and another 300-point reversal gap overnight, challenging even the most experienced traders. I wish I could say the turmoil will be over soon, but there is no way to know how long it will take for the political drama to subside. With the Employment Situation report and the Jerome Powell comments later this morning I would not rule out the possibility of more intraday whipsaws.

With such extreme intraday moves quick day traders continue to have the upper hand with swing and position traders have little to no edge. Holding positions overnight is risky business let alone holding over a weekend. Consider that risk as you plan how to handle the weekend ahead.

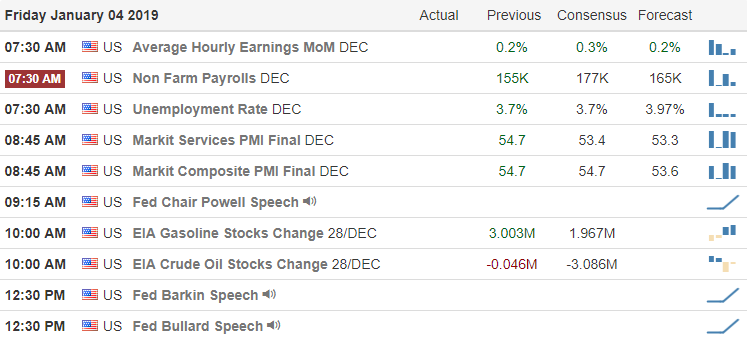

On the Calendar

We have just nine companies reporting earnings today.

Action Plan

The market currently seems to love 300 point gaps this week. Wednesday more than a 300 point gap down a whipsaw back up. Yesterday day more than a 300 point gap done and three whipsaws during the day covering more than 300 points. Now, this morning US Futures are pointing to a 300 point gap up though we are still waiting for the government funding to reopen. The rebound this morning is focused on US-China trade talks improving. With the big Employment Situation report coming out an hour before the market open and the Jerome Powell speaking at 10:15 we could certainly see more whipsaws today.

As always after the morning gap wait to see if buyer’s support the gap and plan for fast price action as extreme price volatility to continue. Once again the current market condition favors quick day trading due to the big intraday swings. The market remains very sensitive to political news as well so plan your risk going into the weekend very carefully.

Trade Wisely,

Doug

Comments are closed.