A CPI reading hotter than expected woke up angry bears Tuesday morning, with indexes failing their 50-day moving average supports once again. As a result, the U.S. dollar surged higher, and treasury yields spiked, adding pressure to an already hawkish FOMC. September lows held as support so far, but with another inflation number, this morning with the PPI, uncertainty abounds. So, prepare for another day of challenging price action as the battle to hold the Sept. lows begins.

Asian markets had a rough night in reaction to the U.S. inflation data, with the Nikkei leading the selling down 2.78%. European markets trade mostly lower this morning as they cautiously wait for the PPI number. However, U.S. futures try to put on a brave face ahead of the producer prices hoping for a hump day bounce after the Tuesday reversal. Once again, anything is possible by the open, and keep in mind the Fed balance sheet runoff ramps up with an FOMC decision next week.

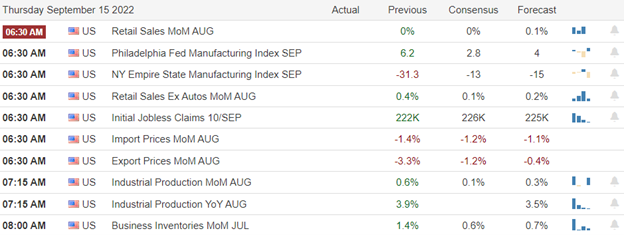

Economic Calendar

Earnings Calendar

As we slide toward the end of the quarter, earnings report numbers continue to dwindle, with only eight confirmed reports today. Notable reports include DOOO & TNP.

News & Technicals’

Rather than fuel, food, shelter and medical services drove costs higher in August, slapping a costly tax on those least able to afford it. As a result, the food at home index, a good proxy for grocery prices, has increased 13.5% over the past year, the most significant rise since March 1979. For medical care services, the monthly increase of 0.8% was the fastest monthly gain since October 2019. Veterinary care was up 10% from a year ago. The consumer price index rose 9.9% annually, according to estimates published Wednesday by the Office for National Statistics. Last week, new British Prime Minister Liz Truss announced an emergency fiscal package capping annual household energy bills at £2,500 ($2,881.90) for the next two years. President Joe Biden and several Cabinet secretaries have been in talks with the railroad unions and the companies for months to try to avert the strike. However, two of the largest unions, representing half of railroad union workers, are still negotiating. That leaves about 60,000 workers ready to strike if a deal is not made. About 40% of the nation’s long-distance trade is moved by rail. If the unions strike, more than 7,000 trains would be idled.

About 40% of the nation’s long-distance trade is moved by rail. If the unions strike, more than 7,000 trains would be idled. As a result, JPMorgan can adjust its cost structure not only by cutting jobs but also by reducing the size of employee bonuses, he said. Trading has provided a welcome boost this year, however. JPMorgan said market revenue was headed for a 5% increase from a year earlier, as strong activity in fixed income offset lower equities trading revenue. Treasury yields continued to rise Wednesday, with the 6-month at 3.72%, the 12-month at 3.87%, the 2-year at 3.78, the 5-year at 3.61%, the 10-year at 3.43%, and the 30-year at 3.51%.

The CPI report woke up some angry bears Tuesday morning, reinforcing aggressive rate increases by the FOMC as food and medical cost increases stepped up to drive inflation. The selling created technical damage as the indexes once again failed their 50-day moving averages. However, September lows are held as price support as we face another inflation this morning with the PPI. The morning’s question is, can the Sept. lows continue to hold after the producer prices come out? We will soon find out, but traders should continue to expect challenging price action. The rising dollar and the sharp increases in bond yields also present a substantial stumbling block for the U.S. market and the global market conditions. Plan for more uncertainty with Fed balance sheet runoffs and rate increases around the corner.

Trade Wisely,

Doug

Comments are closed.