The market hates uncertainty and we this week we have an extra dose of political uncertainty to weigh on the mind of the market. While we watch and wait for new on China/US Trade negotiations, we have the FOMC rate decision and forecasts on Wednesday and the obvious tension that it creates as the market waits for the decision. If that’s not enough drama, we face the possibility of a government shut down on Friday if Congress and the Whitehouse can’t agree on the budget. The hanging point is the border wall so expect an none stop barrage of political spin for the market to chew on this week.

As I write this, the US Futures are pointing to a modest gap down at the open. It seems likely that the indexes will test lower supports but don’t rule out the possibility of a short-term oversold bounce to test the overnight futures highs. Although volatility remains high, there is a possibility of light and choppy price action as the market tests support levels and waits for the FOMC decision. As always maintain your discipline and say focused on price action an remember the next reversal may be just one news report away as the political uncertainty continues.

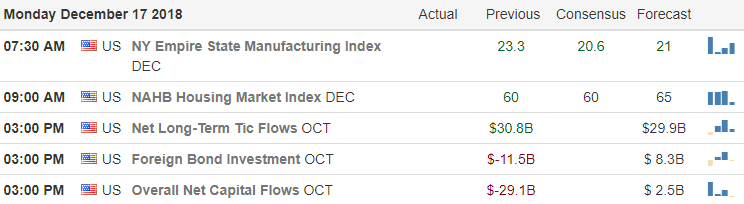

On the Calendar

We have 28 companies stepping up to report earnings this morning. Make sure to keep up your due diligence as 2018 reports continue to wind down.

Action Plan

The Friday selling was disappointing but not all that shocking considering the political uncertainty that continues to swirl. On Wednesday, the market faces the question,will they are will they not decide to increase interest rates as originally expected? And then what do they see in the interest rate future with their FOMC Forecasts? If that’s not enough drama then keep in mind, the government could shut down on Friday unless the Congress and President agree on a new budget let alone the ongoing trade negotiations.

During the evening Futures were at one point slightly higher as the Asian indexes closed mixed but mostly higher. Unfortunately, European markets are all modestly lower this morning, and the US Futures are currently looking fora modestly lower open this morning, A test of lower supports seems very likely but don’t rule out the possibility of a bounce with T2122 indicating a short-term oversold condition. As the FOMC decision approaches to keep in mind that trading could become light and choppy as the market waits for the decision. As always stay disciplined and focused on price action.

Trade Wisely,

Doug

Comments are closed.