Mostly blaming the trade war and slowing sales in China, Tim Cook lowers the revenue projections for AAPL for the first time since the introduction of the iPhone in 2007. Because of the companies heavy weighting in the DIA, SPY, and QQQ we will see sharp declines at the open as investors reprice the tech giant’s value.

Asian markets closed down across the board last night, and European indexes are also lower this morning. Selling pressure in the US Futures is pointing to a gap down of more than 300 Dow points at the open. I think the big question for the day is will the AAPL disappointment spill over into other companies triggering more selling and fear. Expect very fast price action at the open that will challenge even the most experienced day traders. Buckle up it could be a very rough day.

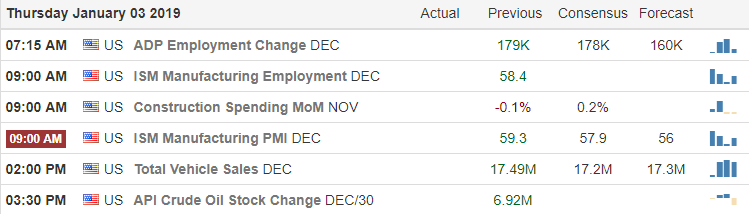

On the Calendar

On the Earnings Calendar, we have 14 companies reporting today.

Action Plan

After gaping down more than 300 points yesterday, positive comments from the President on trade negotiations embolden the bulls recovering to an 18 point Dow gain. This morning the market faces a gap down that will be much harder to recover from and may spawn additional selling in the tech sector. Yesterday after the close AAPL reported disappointing revenue guidance sending the stock sharply lower. With slowing iPhone sales this is the first time AAPL has lowered revenue projections since the popular device came to market in 2007.

Currently, the Dow Futures indicate a gap down open of more than 300 points. With AAPL so heavily weighted in the DIA, SPY, and QQQ it could be a rough day for the market. According to a report, Warren Buffett will lose 2.8 Billion on his AAPL position today. As the power switches isles in the House today the first order of business is electing a new speaker. Once that is complete, they hope to pass several bandaid bills as a temporary patch to reopen parts of the Federal Government while negotiations continue on the border wall. With so much uncertainty expect volatility to be back on the rise this morning fast price action more suitable for day traders than swing and position trading.

Trade Wisely,

Doug

Comments are closed.