With Congress still trying to get it to act together on a massive stimulus bill, the US Futures point to a welcome rally. Though it might prove to be only a monetary relief with quickly rising infection numbers and a death toll sharply rising, any reprieve in the selling that created the fastest 30% decline in history is a welcome relief. We still face a busy week of economic reports with impacts of the outbreak starting to trickle into the numbers. Expect price volatility to continue with lots of news-driven whipsaws and reversals as the market tries to recover.

Asian markets closed in the green across the board with the Nikkei surging more than 7% even after the postponement of the Summer Games. European markets are also in the mood to rally this morning with gains in the DAX over 6% in reaction to the Fed Stimulus. Ahead of earnings from NKE, CCL, and economic reports that include PPI & New Home Sales, US Futures point to a huge gap up at the open. If Congress can pass the stimulus, expect another surge of short-term optimism that could extend the relief rally.

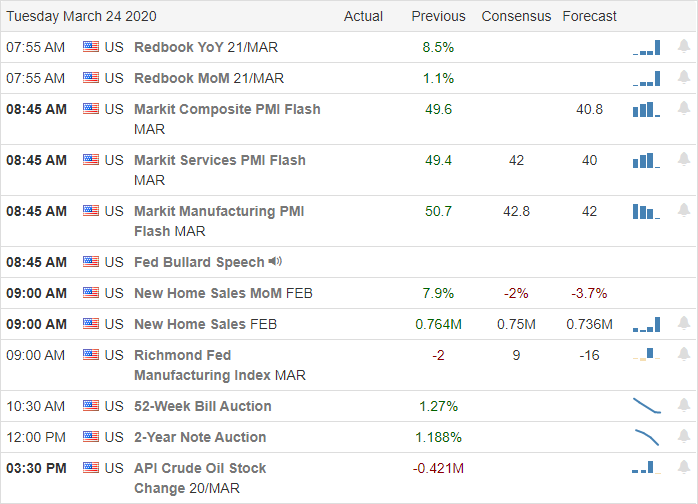

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have 72 companies stepping up to report results. Notable reports include NKE, CCL, CONN, INFO, & SCS.

Top Stories

In the last six weeks, the Dow has lost about 11,000 points, but this morning we have a moment of relief with the US Futures pointing to a rally of more than 900 points. We are still waiting on Congress to decide on a stimulus package that will total more than 2-trillion dollars. The unprecedented move by the FOMC that through the doors open for unlimited asset buying was only able to inspire the bulls for a brief moment yesterday, ultimately closing lower on the day.

With pressure rising, the Olympic Committee has decided to postpone the start of the Summer Games for the first time in history. In wartime, the games Olympic’s experienced full cancellation 3-times but never a postponement. Just another item for the history books alongside the fastest 30% market decline ever. The President said in comments yesterday that he expects a quick recovery for the market. However, reports suggest he like the rest of us is concerned the recovery will be a slow process due to the company level damage and unemployment.

Technically Speaking

With the futures pointing to a substantial gap up and the hope that Congress might get its act together passing the massive stimulus bill, we could finally see a little relief from the selling. Unfortunately, with infections approaching 45,000 and more than 525 reported deaths here in the US, it’s challenging to be in a celebratory mood. The QQQ has the best chance of recovering its 500-day average, but even with the big up expected this morning, the bulls will have to deal with if as resistance.

We will get the latest reading on the PPI and New Home Sales, both of which expect declines according to consensus estimates. As the coronavirus impacts trickle into the earnings and economic reports, we could see volatile price swings that traders will have to consider when holding positions overnight. I suspect the road to recovery will be a very bumpy one with dangerous whipsaws and flat our reversals to challenge trader skills. Don’t forget that consistent base hits win games, not the exciting home runs. When the recovery begins, don’t allow greed to prevent you from taking those base hit trade profits. To be a consistently profitable trader, we have to get comfortable with taking profits consistently.!

Trade Wisely,

Doug

Comments are closed.