Stock futures hovered near the flatline on Wednesday as investors awaited the first Federal Reserve interest rate decision and big tech reports. On Tuesday, tech stocks led the S&P 500 higher, while the Nasdaq Composite surged by 2%, recovering from sharp losses on Monday triggered by concerns over China’s DeepSeek and its potential impact on the artificial intelligence sector. Investors are particularly focused on Fed Chair Jerome Powell’s comments during his first press conference in President Donald Trump’s second term. Additionally, a series of Big Tech earnings reports, including those from Meta Platforms, Microsoft, and Tesla, are expected on Wednesday afternoon.

European markets saw an uptick on Wednesday as investors closely watched a series of corporate earnings reports. Dutch semiconductor equipment maker ASML reported fourth-quarter net sales and profits that exceeded expectations, with net bookings—a crucial measure of order demand—surging by 169% from the previous quarter. Additionally, LVMH, the world’s largest luxury goods company, surpassed sales forecasts in its earnings report released after the market closed on Tuesday.

On Wednesday, Japan and Australian stocks experienced gains as Wall Street’s overnight rebound provided a positive momentum. Japan’s benchmark Nikkei 225 index rose by 1.02%, while the Topix index increased by 0.68%. The release of minutes from the Bank of Japan’s December meeting revealed discussions on neutral interest rates, highlighting the ongoing debate on adjusting borrowing costs amidst inflation rates exceeding the 2% target. Meanwhile, Australia’s S&P/ASX 200 index climbed by 0.57%, driven by a 0.2% rise in inflation for the December quarter and a 2.4% annual increase. Several Asia-Pacific markets, including China, Hong Kong, South Korea, and India, remained closed in observance of the Lunar New Year holiday.

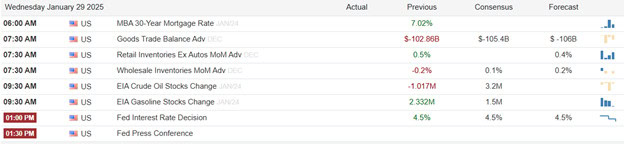

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include AIT, ASML, ADP, AVT, EAT, GLW, DHR, EXP, EXTR, FSV, FLEX, GD, DPI, HES, HESM, LII, MNRO, MSCI, NDAQ, NAVI, NSC, PB, SMG, SLGN, SBSI, TMUS, TEVA, UBS, VFC, & WNC.

After the bell reports include AEM, AMP, AXS, BHC, BHE, CHRW, CALX, CP, CCS, CLB, DLB, ETD, FIBK, IBM, LRCX, LSTR, LEVI, LBRT, META, MXL, MTH, MSFT, NFG, SEIC, SIGI, NOW, TER, TSLA, TTEK, URI, WM, WDC, WHR, & WOLF.

News & Technicals’

Global market attention is focused on the U.S. Federal Reserve’s first-interest rate decision of 2025, scheduled for Wednesday. According to CME Group data, Fed funds futures indicate nearly 100% certainty that the central bank will maintain rates within the target range of 4.25% to 4.50%. Despite this high level of confidence, investors will closely monitor the decision and Fed Chair Jerome Powell’s subsequent press conference for insights into the future trajectory of interest rates this year.

Norway’s massive sovereign wealth fund reported a full-year profit of 2.5 trillion kroner ($222.4 billion) on Wednesday. Managed by Norges Bank Investment Management, the fund’s impressive returns were largely fueled by the AI boom that propelled tech stocks higher in 2024. The fund achieved a return on investment of 13% for the year, reflecting the significant impact of advancements in artificial intelligence on the market.

U.S. Treasury yields fell on Wednesday as investors anticipated the Federal Reserve’s first interest rate decision of 2025. By 5:49 a.m. ET, the 10-year Treasury yield had decreased by 2.5 basis points to 4.524%, and the 2-year Treasury yield had dropped by 1 basis point to 4.191%. Paul Hickey, co-founder of Bespoke Investment Group, remarked on CNBC that minimal action from the Fed would be favorable for the market. Following the rate decision announcement, Fed Chair Jerome Powell will hold a press conference at 2:30 p.m. ET, which investors will scrutinize for insights into future monetary policy decisions this year.

Apple supplier Qorvo experienced a swift reversal in its stock price after issuing a warning about potential weakness. Initially, Qorvo shares surged over 13% following the announcement of better-than-expected earnings. However, the stock’s momentum reversed after CEO Robert Bruggeworth commented on sales to the company’s largest customer, forecasting flat to modest revenue growth for FY 2026. Although Qorvo did not name the customer, it was revealed that this customer accounted for just over half of the company’s revenue in the December period.

Caution is the word of the day for me with the uncertainty of the interest rate decision and big tech reports extreme price volatility is possible. Plan your risk carefully, avoid the fear of missing out chase and think about protecting your current profits and account capital.

Trade Wisely,

Doug

Comments are closed.