Stock futures rose on Tuesday as Donald Trump began his second term as president with a series of executive orders, however no tariffs for the moment. A positive market reaction followed Trump’s statement that he was not yet ready to impose universal tariffs. Wall Street’s attention is now on whether Trump will deliver on his pro-business promises, particularly his calls for looser regulations, which had previously boosted banking stocks after his election win in November. Other elements of the “Trump trade,” such as small-cap stocks, oil stocks, and bitcoin, are expected to be highly sensitive to the direction of his administration’s policies.

European stocks opened with mixed results on Tuesday. Orsted shares plummeted by 15% following the announcement of a fourth-quarter loss of 12.1 billion Danish Krone ($1.7 billion) related to its U.S. offshore wind turbine projects. European automakers Stellantis and BMW also saw declines due to concerns over potential U.S. tariffs. In the U.K., private sector wages increased by 6% in the three months leading up to November compared to the previous year, according to the Office for National Statistics. However, the agency also reported a 0.1% drop in November payroll figures compared to October, indicating a weakening labor market.

Asia-Pacific markets showed mixed but mostly positive movements on Tuesday as investors awaited further policy clarity from U.S. President Donald Trump. Australia’s S&P/ASX 200 saw a gain of 0.66%, while South Korea’s Kospi experienced a slight decline of 0.08%. In Japan, the Nikkei 225 rose by 0.32% to close at 39,027.98, and the Topix edged up by 0.08% amid volatile trading. Hong Kong’s Hang Seng index increased by 1.02%, and Mainland China’s CSI 300 Index saw a modest rise of 0.08%. Investors are also keeping an eye on upcoming central bank meetings, with the Bank of Japan’s policy meeting scheduled for January 23-24, where Governor Kazuo Ueda has hinted at potential rate hikes, and Singapore’s Monetary Authority set to meet on Friday.

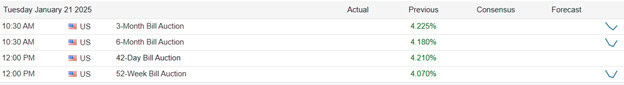

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include MMM, SCHW, CBU, DHI, FBK, FITB, KEY, EDU, ONB, PEBO, PGR, & PLD. After the bell reports include AGYS, CNI, COF, FULT, HWC, IBKR, CASH, NFLX, PNFP, PGRS, RBB, STX, SFNC, UAL, WTFC, & ZION.

News & Technicals’

Costco Teamsters, representing 18,000 employees nationwide, announced that 85% of its members voted in favor of strike action. With the current contract set to expire on January 31, a strike could significantly disrupt Costco’s daily operations. This potential strike also poses a risk to Costco’s public image, which has been bolstered by its reputation for positive worker treatment and support for diversity and inclusion initiatives. The union has scheduled a final week of negotiations with Costco, as mentioned in a recent X post. Last week, the Teamsters conducted practice pickets in various locations, including San Diego and Long Island, New York, to prepare for a possible strike.

President Donald Trump announced on Monday that tariffs of up to 25% could be imposed on Mexico and Canada as early as February 1st. He cited concerns over the number of people crossing the border as a reason for these potential levies. Trump labeled Canada as “a very bad abuser” and indicated that the tariffs would be broad-based rather than targeted at specific essential items. This announcement underscores Trump’s intensified focus on trade and his plans to implement widespread duties on U.S. trading partners, though the exact timing and scope had previously been uncertain.

European business leaders have shared mixed reactions to Donald Trump’s first day in office. Some are optimistic, believing that Trump’s administration could revitalize America’s economic spirit by reducing regulations, increasing energy supply, and fostering a more market-driven environment. One leader expressed that Trump could be a significant boost for business, but also emphasized the need for businesses to balance the interests of various stakeholders, including employees, and to address issues like diversity, equity, inclusion (DEI), and sustainability. Others, however, have adopted a more cautious stance, awaiting further developments before forming a definitive opinion.

Chinese Vice Premier Ding Xuexiang emphasized that there are “no winners” in a trade war, as China faces potential tariffs from the newly inaugurated administration of Donald Trump. Speaking at the World Economic Forum in Davos, Switzerland, Ding warned that protectionism is counterproductive and reiterated that a trade war benefits no one. His address echoed sentiments from Chinese President Xi Jinping’s 2017 Davos speech, which occurred just days before Trump began his first term. Ding’s remarks highlight China’s concerns about the economic impact of Trump’s trade policies.

The quick fluctuation in the value of the dollar highlights the tariff uncertainty. Although there are no tariffs now, he suggested he is thinking of 25% increases maybe on the way the first of February. Also keep in mind with earnings ramping up we should plan on higher-than-normal volatility. Plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.