Stock futures edged higher on Wednesday as investors anticipated a crucial earnings report from tech giant Nvidia, which is set to release its results after the market close. Market participants are particularly interested in the demand for Nvidia’s Blackwell AI chips. Given Nvidia’s substantial market capitalization of $3.6 trillion, its performance could significantly influence the S&P 500 and Nasdaq Composite for the remainder of the week. Additionally, retailers Target and TJX are scheduled to report their earnings on Wednesday morning. Investors will also be paying close attention to remarks from Federal Reserve Governors Lisa Cook and Michelle Bowman, along with Boston Fed President Susan Collins.

European markets opened on a positive note early Wednesday, with the pan-European Stoxx 600 rising by 0.5% in early trading. Most sectors were in the green, except for the automotive sector. The FTSE 100 started flat but gained 0.2% following the release of data showing U.K. inflation surged to 2.3% in October, surpassing expectations. On the Stoxx 600, Sage Group emerged as the top performer, with its shares soaring nearly 17%, while national lottery operator La Française des Jeux (FDJ) was the worst performer, dropping by 5%.

Asia-Pacific markets experienced mixed performance in volatile trading on Wednesday, influenced by escalating geopolitical tensions between Ukraine and Russia. Investors closely analyzed Japan’s October trade data, which showed a year-over-year export growth of 3.1%, a significant improvement from the 1.7% decline in September. Import growth also exceeded expectations at 0.4%, although it was lower than the previous month’s 2.1%. Japan’s Nikkei 225 index dipped by 0.16%, while Hong Kong’s Hang Seng Index edged up by 0.24%. South Korea’s Kospi gained 0.42%, but the Kosdaq fell by 0.47%. Meanwhile, Australia’s S&P/ASX 200 dropped by 0.57%.

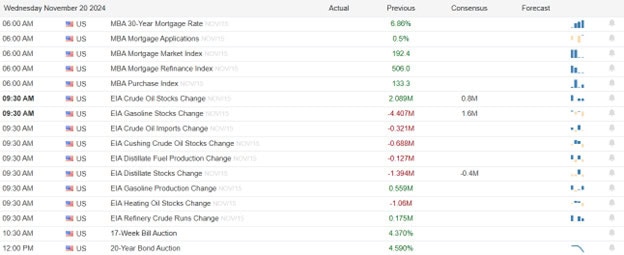

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include BERY DY, GLBE, NIO, SR, TGT, TJX, & WIX. After the bell reports include CPA, JACK, MMS, NVDA, PANW, SNOW, & SQM.

News & Technicals’

The U.S. closed its embassy in Kyiv on Wednesday, citing specific intelligence about a potential significant air attack amid escalating tensions with Russia. In a statement, the U.S. Embassy announced the closure as a precautionary measure and advised embassy staff to shelter in place. Additionally, the embassy urged U.S. citizens to be ready to take immediate shelter if an air alert is issued.

Comcast is advancing with plans to spin off its cable network channels, according to sources cited by CNBC on Tuesday. The process is anticipated to take about a year, with an official announcement possibly coming as soon as Wednesday. This strategic move aims to provide cable networks with flexibility to merge with other networks or be sold to private equity. The decision comes as millions of customers shift from traditional pay TV bundles to streaming services. Over the next year, Comcast will determine necessary licensing agreements and decide if MSNBC and CNBC will continue their collaboration with NBC News.

U.S. Treasury yields rose on Wednesday as investors weighed the geopolitical tensions and recent economic data. The yield on the 10-year Treasury increased by nearly 5 basis points to 4.426%, while the 2-year Treasury yield climbed by over 2 basis points to 4.297%. The market’s focus was on the escalating conflict between Russia and Ukraine, which has intensified tensions between the U.S. and Russia. In response to the heightened threat, the U.S. closed its embassy in Kyiv, warning of a potential significant air attack.

Target reported disappointing third-quarter earnings and revenue, falling short of analysts’ estimates and prompting the company to lower its full-year guidance. Despite efforts to boost sales by cutting prices on thousands of items, Target struggled to attract customers. This underperformance stands in stark contrast to Walmart, which exceeded Wall Street expectations and raised its outlook just a day earlier.

Despite the dangerous geopolitical situation, the market continues with high anticipation of the crucial earnings from NVDA after the bell today. Obviously, this report could set the sentiment of the market for the rest of the week so be prepared for a substantial Thursday morning gap. The question is will it be up or down? Plan your risk carefully and while keeping in mind a significant air strike out of Russia could occur at any time escalating the conflict.

Trade Wisely,

Doug

Comments are closed.