Wall Street is working to stabilize after a mixed session on Wednesday, with Nasdaq 100 futures rising by 1.3%. This boost was largely driven by Micron Technology, whose shares surged 14% in extended trading following the release of strong guidance for the current quarter. Traders are now looking ahead to the weekly jobless claims report, expected on Thursday, with economists surveyed by Dow Jones predicting 223,000 initial unemployment claims for the week ending September 21.

European stocks saw an uptick on Thursday morning, driven primarily by a strong performance in the mining sector, which surged over 3.6%. Technology and household goods stocks also contributed to the positive momentum, each rising around 3%. Conversely, oil and gas stocks declined by more than 2.8% following a Financial Times report indicating that Saudi Arabia is considering abandoning its unofficial oil price target of $100 per barrel. Among the notable gainers, shares of the French luxury group Kering climbed significantly.

Chinese stocks continued their upward trajectory as state media reported that the nation’s top leaders had endorsed the government’s recent economic support measures. The CSI 300 index in Mainland China extended its winning streak to seven consecutive days, reaching its highest point in approximately four months following a pivotal meeting that reaffirmed the government’s commitment to stimulus efforts. Meanwhile, South Korea’s Kospi surged by 1.9%, driven by significant gains in SK Hynix. The chip maker announced the commencement of mass production of the world’s first 12-layer HBM3E chip, designed for AI memory applications.

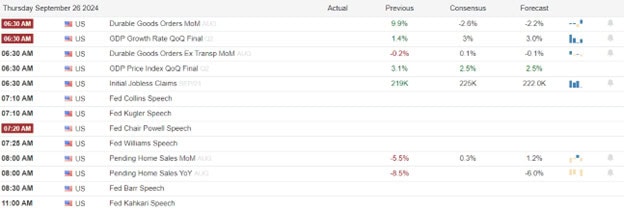

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell include CAN, KMX, JBL, & SNX. After the bell reports include COST, BB, & MTN.

News & Technicals’

Global chip stocks experienced a significant rally on Thursday following U.S. memory semiconductor maker Micron’s announcement of revenue guidance that exceeded expectations, propelling its share price upward. This positive sentiment extended to South Korea, where shares of Samsung Electronics and SK Hynix also saw gains. In Europe, Dutch semiconductor equipment maker ASML surged over 4% in early trading. Other semiconductor companies, including ASMI, BE Semiconductor, and STMicroelectronics, also posted sharp increases.

Russian President Vladimir Putin announced that Russia is making several clarifications to its nuclear doctrine, specifically defining the conditions under which nuclear weapons may be used. He mentioned that the draft amendments to the doctrine will broaden the scope of states and military alliances subject to nuclear deterrence. In a stern warning to Western nations, Putin declared that any attack on Russia by a non-nuclear state, if supported by a nuclear-armed nation, would be treated as a “joint attack,” signaling a significant shift in Russia’s strategic defense policy.

The Federal Trade Commission (FTC) is intensifying its efforts against “automation” companies that promise to launch and manage online businesses for customers in return for an upfront investment. The latest target of this crackdown is Ascend Ecom, which operated an e-commerce scheme primarily on Amazon. The FTC has accused Ascend and similar companies of misrepresentation and making deceptive earnings claims, highlighting the need for greater scrutiny and regulation in this sector to protect consumers from fraudulent business practices.

OpenAI’s board is currently deliberating plans to restructure the organization into a for-profit business. This news follows the announcement by Chief Technology Officer Mira Murati that she will be leaving the company after six and a half years. Later the same day, CEO Sam Altman revealed that Chief Research Officer Bob McGrew and Vice President of Research Barret Zoph are also set to depart. These significant leadership changes come at a pivotal moment for OpenAI as it considers a major shift in its business model.

With the earnings results out of MU the market is once again all excited about AI as the institutions work to stabilize the sector pushing new record highs in the SPY at the open. However, it would be wise to be careful chasing at the open and watch for potential whipsaws as the market reacts to huge day of economic data and Fed speakers including the Chairman himself.

Trade Wisely,

Doug

Comments are closed.