Stock futures remained mostly flat on Tuesday, following a rebound from the worst week of 2024 for major averages. Traders are closely monitoring two significant economic reports expected to influence stock movements: the consumer price index (CPI) report for August, due on Wednesday, and the producer price index (PPI) report, set for release on Thursday. Historically, September tends to be a weak month for equities, adding to investor caution. Additionally, the looming U.S. presidential election on November 5th contributes to the prevailing uncertainty in the market.

European stocks showed a mixed performance on Tuesday, following a more optimistic start to the week. The U.K. saw a slight improvement in its unemployment rate, which eased to 4.1% from May to July 2024. However, annual growth in regular employee earnings declined to 5.1% during the same period. Tech stocks experienced a modest gain of 0.63%, while the healthcare sector dropped by 0.87%, largely due to AstraZeneca’s significant 4.33% fall. The British pharmaceutical giant’s shares plummeted to the bottom of the FTSE 100 after it reported disappointing results from a lung cancer drug trial.

Asia-Pacific markets displayed a mixed performance on Tuesday. China’s exports surged by 8.7% year-on-year in August, surpassing the forecast of 6.5%, while imports saw a modest increase of 0.5%, falling short of the expected 2%. Japan’s Nikkei 225, after initial gains, closed 0.16% lower at 36,159.16, primarily due to a downturn in the health-care sector. Meanwhile, Hong Kong’s Hang Seng index rose by 0.37% in the final hour of trading, and mainland China’s CSI 300 remained relatively stable at 3,195.76.

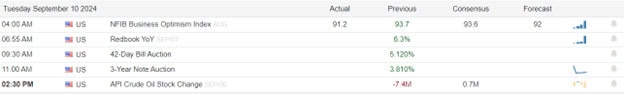

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell include ASO, & CGNT. After the bell include GME, PLAY, & WOOF.

News & Technicals’

Oracle reported strong fiscal first-quarter results on Monday, surpassing expectations on both the top and bottom lines. This positive performance led to a rise in the company’s stock during extended trading. Additionally, Oracle announced plans to offer its database services on Amazon Web Services (AWS), the leading cloud infrastructure platform. This strategic move is expected to enhance Oracle’s cloud capabilities and expand its market reach.

Goldman Sachs is set to incur a pretax hit of approximately $400 million in its third-quarter results as it continues to dismantle its troubled consumer business. CEO David Solomon announced at a conference on Monday that the bank’s decision to offload its GM Card business and a separate loan portfolio would negatively impact revenues next month. Additionally, Solomon noted that trading revenue for the quarter is expected to decline by 10%, attributed to challenging year-over-year comparisons and difficult trading conditions in the fixed-income markets during August.

Europe’s top court ruled against Apple on Tuesday in a decade-long legal battle concerning its tax practices in Ireland. The case originated in 2016 when the European Commission mandated that Ireland recover up to 13 billion euros ($14.4 billion) in back taxes from Apple. The Commission had determined that Apple received “illegal” tax benefits from Ireland over a span of two decades. This ruling marks a significant development in the ongoing scrutiny of multinational corporations’ tax arrangements in Europe.

Europe’s also upheld a 2.4-billion-euro ($2.65 billion) fine against Google on Tuesday for abusing its dominant market position by favoring its own shopping comparison service. This fine results from a 2017 antitrust investigation by the European Commission, the EU’s executive arm, which concluded that Google had unfairly prioritized its own service over those of its competitors. This ruling reinforces the EU’s stance on maintaining competitive fairness in the digital marketplace.

As the market waits for the Wednesday CPI report the futures trade mostly Flat this morning. A hurry up and wait choppy Tuesday is not out of the question with very little inspiration coming for either earnings or economic today. Try to avoid trading out of boredom keeping mind the potential market moving report before the bell tomorrow that could create significant gaps both up or down.

Trade Wisely,

Doug

Comments are closed.