US equity futures saw modest gains as traders anticipated a busy morning filled with economic data releases. Investors are particularly keen on the upcoming retail sales data, which will provide further insights into the economic trajectory. Additionally, Walmart’s earnings report, scheduled for release before the market opens, is expected to shed light on consumer spending patterns, making it a focal point for market watchers.

On Thursday, European stocks continued their upward trend, buoyed by cooler-than-expected inflation readings that bolstered investor confidence. This positive momentum was further supported by the latest U.K. GDP data, which revealed a 0.6% expansion in the second quarter, aligning with market expectations. The combination of these factors contributed to a generally optimistic outlook for European markets as the week progressed.

In the second quarter, Japan’s economy outperformed market expectations, with its gross domestic product (GDP) rising by 0.8% quarter-on-quarter, surpassing the 0.5% increase anticipated by economists polled by Reuters. Meanwhile, China’s retail sales experienced a year-on-year growth of 2.7%, slightly exceeding the forecasted 2.6% growth. However, the urban unemployment rate in China saw a minor uptick, climbing to 5.2% from 5% in June.

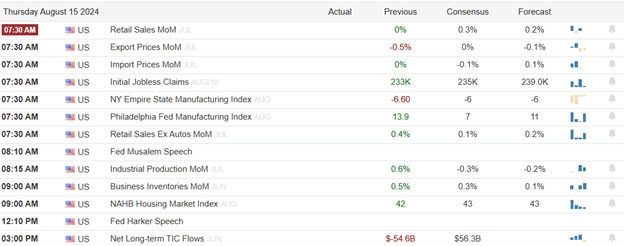

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell include WMT, BABA, AIT, CLBT, GRAB, NICE, SPTN, & TPR. After the bell include AMCR, AMAT, COUR, HRB, & ROST.

News & Technicals’

Cisco reported its third consecutive quarter of declining revenue, marking its first full fiscal year drop since 2020. Despite this, the company’s earnings and revenue exceeded analysts’ expectations. In response to the ongoing challenges, Cisco announced a 7% reduction in its global workforce. Prior to Wednesday’s close, Cisco’s stock had fallen by 10% this year, contrasting sharply with the Nasdaq’s approximately 15% gain.

More than a week into Ukraine’s unexpected incursion into Russia’s Kursk region, the gains have likely surpassed Kyiv’s highest expectations. Ukrainian forces now control over 1,000 square kilometers of Russian territory and have captured 74 settlements, according to Ukraine’s top military commander, Oleksandr Syrskyi. While Moscow has yet to mount a significant response, it has warned of a ‘worthy’ retaliation. Analysts suggest that Ukraine faces a critical decision: whether to reinforce its troops and hold or advance its position, or to withdraw before Russia launches what is expected to be a fierce and deadly counterattack.

Starbucks has announced a substantial compensation package for its incoming CEO, Brian Niccol, who is transitioning from Chipotle. Niccol will receive $10 million in cash and $75 million in equity awards upon joining the company. His annual base salary will be $1.6 million, with the potential to earn an additional $7.2 million in cash. As he steps into his new role, Niccol faces the significant challenge of revitalizing Starbucks’ struggling business.

Payments firm Airwallex has achieved an impressive annual revenue run rate of $500 million, driven by substantial growth in its North American and European operations, according to CEO Jack Zhang. Zhang aims to prepare Airwallex for an initial public offering (IPO) by 2026. The company, which was recently valued at $5.6 billion and is backed by Tencent, is considered a strong contender among major fintech IPO candidates.

With a very busy morning of potential market-moving economic data traders should prepare for just about anything. The relief rally is starting to get a little long in the tooth and perhaps today’s data can continue to inspire the bull higher. However, we should not be surprised to see a little profit-taking begin at any time. That said, avoid chasing with the fear of missing out.

Trade Wisely,

Doug

Comments are closed.