Stock futures surged on Wednesday as the recovery rally continues, with the indexes quickly closing in on substantial overhead resistance. Investors were eager to recoup more of the losses on Monday. Despite the broad-based rally on Tuesday, which saw gains across all 11 sectors of the S&P 500, the sustainability of this rebound remains uncertain. LPL Financials’ chief global strategist, Quincy Krosby, cautioned that turbulent times may still lie ahead, reflecting the ongoing volatility and unpredictability in the market.

European stocks saw an uptick on Wednesday as global markets attempted to recover from Monday’s significant downturn. The regional markets have been volatile, experiencing sharp declines at the start of the week. On Tuesday, European markets opened on a positive note but later reversed course, ending the day lower amid choppy trading. This seesaw pattern reflects the ongoing uncertainty and cautious sentiment among investors as they navigate the fluctuating global market conditions.

Asia-Pacific markets experienced a positive uptick on Wednesday, buoyed by a rebound in major Wall Street indexes that ended a three-day losing streak. Investors in the region closely analyzed China’s July trade balance data, which revealed a faster-than-anticipated growth in imports. However, this optimism was tempered by the fact that exports fell short of expectations. This mixed trade data from China played a significant role in shaping market sentiment across Asia.

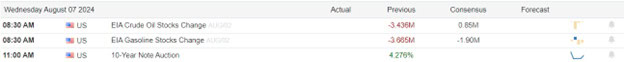

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include DIS, ACMR, ASTE, AVA, BTG, BCO, BN, CEVA, CRL, CNDT, CVS, DIN, DT, EDIT, EMR, ENOV, EXTR, GPN, GOGO, GFF, HLT, HLLY, IMXI, INSW, ITCI, KMT, KRNT, KYMR, LPX, LYFT, NYT, NI, NOMD, ODP, OGE, OSCR, PAYO, PLTK, RL, REYN, ROK, ROX, SHOP, SU, SUN, TBLA, TH, TGI, PRKS, VVV, VERX, WMG, WIX, WWW, & ZBH. After the bell include ACVA, ASLE, ALLO, DOX, APP, ATO, BYND, BLNK, BOOT, BHF, BMBL, CACI, CENT, CF, CHRD, CLNE, CDE, CWX, CW, DGII, APPS, DBRG, DLB, DUOL, BROS, ET, ENS, NVST, EQIX, FSLY, FLNC, FRWD, FNV, GNK, GH, HCAT, HOOD, HI, HMN, HUBS, HPP, ICUI, JXN, FROG, KVYO, KTOS, KLIC, LZ, LESL, RAMP, MGNI, MTW, MNKD, MFC, MRO, MCK, MNST, NTR, OXY, PAAS, PETQ, PRI, RYN, RGLD, SRPT, SBGI, SITM, SM, SEDG, SONO, STAA, TALO, MODG, UGI, UPRK, VSAT, VTLE, WBD, WTS, WES, ZD, & ZG.

News & Technicals’

Claudia Sahm, chief economist at New Century Advisors, asserts that the U.S. Federal Reserve does not need to implement an emergency rate cut, despite the recent economic data falling short of expectations. Sahm’s perspective suggests confidence in the current monetary policy framework, indicating that the weaker-than-expected data does not warrant immediate intervention. This stance reflects a measured approach to economic fluctuations, emphasizing stability over reactive measures.

A recurring theme in the latest earnings reports from U.S. companies is the negative impact of the China market. Starbucks reported a significant 14% drop in same-store sales in China for the quarter ending June 30, compared to a modest 2% decline in the U.S. McDonald’s chairman and CEO, Christopher Kempczinski, highlighted the weak consumer sentiment in China during the same period. Similarly, General Mills CFO, Kofi Bruce, noted that after a strong start to the year, the quarter ending May 26 experienced a notable downturn in consumer sentiment. These reports underscore the challenges U.S. companies are facing in the Chinese market, reflecting broader economic uncertainties.

A recurring theme in the latest earnings reports from U.S. companies is the negative impact of the China market. Starbucks reported a significant 14% drop in same-store sales in China for the quarter ending June 30, compared to a modest 2% decline in the U.S. McDonald’s chairman and CEO, Christopher Kempczinski, highlighted the weak consumer sentiment in China during the same period. Similarly, General Mills CFO, Kofi Bruce, noted that after a strong start to the year, the quarter ending May 26 experienced a notable downturn in consumer sentiment. These reports underscore the challenges U.S. companies are facing in the Chinese market, reflecting broader economic uncertainties.

The vacation rental company, Airbnb, has cautioned investors about a potential slowdown in year-over-year growth for its key “Nights and Experiences” category in the upcoming quarter. The company noted a trend of shorter booking lead times globally and observed some signs of decreasing demand from U.S. guests. Despite these concerns, Airbnb reported a record-breaking 125.1 million Nights and Experiences booked in the second quarter, marking its highest result for this period. This mixed outlook highlights both the company’s recent successes and the challenges it anticipates in maintaining growth momentum.

Another day and yet another big overnight gap as the recovery rally continues but I highly recommend caution as we approach significant price and technical overhead resistance. According to JP Morgan the yen carry trade still has about 50% unwind left so avoid chasing with the fear of missing out. Remember the VIX remains very elevated so along with big gaps comes the possibly of big point whipsaws.

Trade Wisely,

Doug

Comments are closed.