U.S. stock futures plummeted on Monday, contributing to a global market sell-off. Investors are increasingly worried that the Federal Reserve is lagging in reducing interest rates to counteract the economic slowdown. Additionally, there is a notable unwinding of the previously booming artificial intelligence trade. As a result, tech shares were among the worst performers in early trading on Monday.

European stocks experienced a sharp decline at the start of Monday’s session, driven by ongoing global volatility and concerns over a potential U.S. recession. Tech stocks initially dropped by as much as 5% before slightly recovering to trade down 3.5%. Similarly, oil and gas stocks fell by 3.94%, while banking stocks were down 3.62%. The VIX, an indicator of expected market volatility, surged to 41.65, its highest level since October 2020, reflecting the mounting recessionary fears.

The Nikkei experienced a significant 12.4% drop, marking its worst day since the infamous “Black Monday” of 1987. This sharp decline erased all the gains the index had accumulated throughout the year, pushing it into a loss position. Concurrently, the yen strengthened to its highest level against the dollar since January, with the exchange rate last recorded at 142.09. In South Korea, the Kospi index also faced a substantial fall of 8.77%, triggering circuit breakers that halted trading for 20 minutes to curb the market’s volatility.

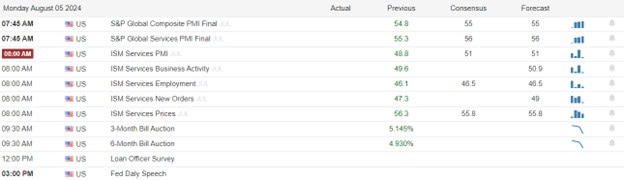

Economic Calendar

Earnings Calendar

Notable reports for Monday before the bell include AMR, BCRX, BNTX, CG, FRPT, CRYS, SAH, SHC, THS, &TSN. After the bell include, ADUS, ADTN, ACM, AMRC, AHR, AESI, SESI, CAR, BRBR, BCC, BWXT, CBT, CSWC, CHGG, CSX, DH, FANG, EHC, WTRG, EVER, FNF, GBDC, HPK, HIMS, HUN, IIPR, JJSF, JRVR, KMPR, MTRN, MWA, NSA, NVTS, OGS, OKE, OTTR, PLTR, PLMR, PLAYA, PRIM, KWR, O< SPG, SPR, SUM, TDC, AAN, TBI, UIS, VEMO, VNOM, VSTO, VNO, WMB, YUMC, & ZI.

News & Technicals’

Berkshire Hathaway’s cash reserves surged to an unprecedented $276.9 billion last quarter, driven by Warren Buffett’s substantial divestment in stock holdings, including Apple. This marked a significant increase from the previous record of $189 billion set in the first quarter of 2024. The notable rise in cash hoard occurred after the Oracle of Omaha sold nearly half of his stake in the Tim Cook-led tech giant during the second quarter.

Treasury yields fell on Monday as investors sought refuge in traditionally safer assets amid a global stock market sell-off driven by fears of a looming U.S. recession. Early this morning, the yield on the 10-year Treasury dropped by 5 basis points to 3.744%, reaching its lowest level since July 2023. Meanwhile, the 2-year Treasury yield decreased by more than 9 basis points, settling at 3.772%.

The yen exchange rate has emerged as a key driver of global markets, according to financial historian Russell Napier. In a recent installment of his “Solid Ground” macro strategy report, Napier, co-founder of the investment research portal ERIC, highlighted how changes in Japanese monetary policy can significantly impact U.S. financial markets. His observations come at a time when many market participants have been surprised by the rapid rally of the yen.

UBS has issued a cautionary note about investing in Japan, likening it to “catching a falling knife.” According to Kelvin Tay of UBS, the primary reason for the strong performance of the Japanese market over the past two years has been the significant weakness of the Japanese yen. While Tay acknowledged that corporate restructuring efforts by the Tokyo Stock Exchange have contributed to some market gains, he emphasized that the main driver has been the yen’s depreciation.

As the global market sell-off intensifies try not to panic. Focus carefully on your trading plan and rules. Expect massive price volatility with wide bid/ask spreads with options prices jumping due to with will implied volatility change. This will pass and there will eventually be a relief rally but be very thoughtful avoiding revenge or shooting from the hip trading because the whipsaws can very punishing. Plan carefully and remember CASH is a position!

Trade Wisely,

Doug

Comments are closed.