The S&P 500 futures Thursday, with PPI in focus with a side order of jobs data before the bell. This followed closely on the heels of the Federal Reserve’s latest interest rate decision, which, along with a May consumer inflation report that was more subdued than anticipated. Broadcom stood out with its shares leaping 14% in premarket trading, announcing an enticing 10-for-1 stock split.

European markets faced a downturn on Thursday, with the Stoxx 600 index falling 0.6% by 9:45 a.m. in London, a stark contrast to the robust gains it had secured the previous day. The volatility was particularly pronounced in the case of the French IT giant Atos, whose shares experienced a dramatic 14% drop following the announcement of the divestiture of its consultancy arm, Worldgrid.

Asian markets traded mixed but mostly higher. Leading the charge was South Korea’s Kospi, increased of 0.98%, closing at 2,754.89. Over in Hong Kong, the Hang Seng index also participated in the rally, climbing 0.87%.

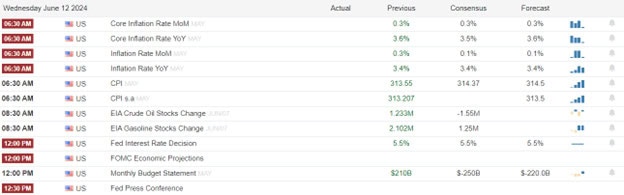

Economic Calendar

Earnings Calendar

Notable reports for Thursday before the bell include KFY, SIG, MDRX, & WLY. After the bell includes ADBE.

News & Technicals’

Elon Musk, CEO of Tesla, has indicated that the company’s shareholders are poised to endorse his contentious $56 billion pay package, alongside a resolution to relocate Tesla’s corporate domicile to Texas. This substantial compensation plan, which was initially ratified in 2018, set forth ambitious benchmarks for Tesla’s financial metrics and valuation. While some detractors have voiced concerns over the enormity of the package and Musk’s potential diversion of focus due to his involvement with other ventures, including a social media platform, proponents maintain that Musk’s leadership and innovative drive are indispensable for Tesla’s continued prosperity and pioneering role in the electric vehicle industry. The debate encapsulates the broader discourse on executive remuneration and the impact of dynamic leadership on corporate success.

The trading landscape for GameStop shares took a dramatic turn on Wednesday afternoon as a significant sell-off ensued. Amidst this market activity, attention was drawn to “Roaring Kitty,” also known as Keith Gill, a prominent figure in the GameStop trading frenzy. The latest disclosure of his investment portfolio revealed on Monday night that he retained ownership of 120,000 call options contracts. These contracts are characterized by a strike price of $20 and are set to expire on June 21. In a remarkable display of market movement, GameStop call options matching Gill’s strike price and expiration date saw a staggering 93,266 contracts being traded on Wednesday, highlighting the volatile nature of the stock and the keen interest of traders in these specific options.

Digital wallets have become a cornerstone in the global payment landscape, as evidenced by their substantial share in both e-commerce and brick-and-mortar transactions. In 2023, digital wallets were responsible for 50% of all e-commerce purchases and 30% of in-store purchases, amassing a staggering $14 trillion in transaction value. This trend is expected to continue its upward trajectory, with projections estimating that digital wallet transactions will reach an impressive $25 trillion by 2027. The Asia-Pacific region, in particular, has embraced this payment method with open arms; 70% of online payments and 50% of in-store payments were conducted through digital wallets last year, the highest adoption rate globally. China is at the forefront of this digital revolution, leading the world with 82% of e-commerce and 66% of in-store purchases made via digital cards, contributing to approximately $7.6 trillion in transactions. This data not only highlights the growing consumer preference for digital wallets but also underscores the significant role they play in shaping the future of financial transactions worldwide.

The wild price volatility and whipsaws could continue this morning with the PPI in focus along with Initial Claims to keep traders guessing. However, big tech continues to surge after the Broadcom reports expecting another new record high in the Nasdaq at the open.

Trade Wisely,

Doug

Comments are closed.