The wait is over, and the big data day begins with stock futures putting on a brave face ahead of May’s CPI report and the Federal Reserve’s decision. Meanwhile, Oracle saw its shares surge by 9%, who were more enthused by the company’s announcement of new cloud computing agreements with tech giants Google and OpenAI than concerned by the earnings shortfall reported in Oracle’s most recent quarterly results.

European markets also moved higher ahead of the decision from the U.S. Federal Reserve and the release of the latest inflation data. This positive sentiment comes despite the economic stagnation in the U.K., where growth remained static in April, due to a persistent decline in construction.

China’s inflation rate was recorded at 0.3%, falling short of the anticipated 0.4% forecasted by a Reuters poll. This discrepancy points to a slower-than-expected rise in prices, which could signal a variety of economic factors at play, including subdued consumer demand or government policies aimed at controlling inflation. Meanwhile, Japan experienced a notable uptick in its corporate goods inflation rate, which climbed to 2.4% in May. This increase exceeded market expectations and represented the most rapid escalation since August, indicating heightened cost pressures within the corporate sector.

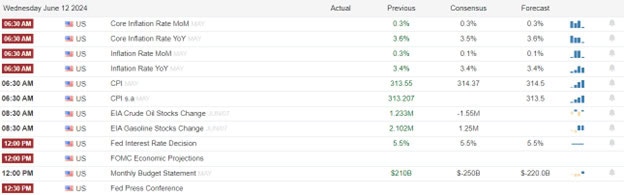

Economic Calendar

Earnings Calendar

Notable reports for Wednesday there are no notable reports before the bell today. After the bell include AVGO, PLAY, OXM, & CURV.

News & Technicals’

The European Union announced on Wednesday a significant policy shift, deciding to levy increased tariffs on Chinese electric vehicles. According to the EU’s statement, a substantial 38.1% tariff will be applied to battery electric vehicle (BEV) manufacturers from China who failed to participate in the EU’s investigation. Conversely, for those Chinese carmakers who did cooperate with the inquiry but were not selected for “sampling,” a reduced tariff rate of 21% will be imposed. This move underscores the EU’s stringent stance on trade compliance and reflects the growing scrutiny over the competitive practices of the electric vehicle industry, which is central to the global shift towards sustainable transportation.

The upcoming launch of a new headset in China is poised to make a notable entry into the market with a premium pricing strategy. This device will feature applications from local developers, harnessing the technological prowess of Chinese powerhouses such as Tencent and ByteDance. The strategic decision to host apps from these tech giants could enhance the headset’s appeal within the domestic market. Furthermore, the headset’s accelerated entry into international markets, sooner than initially anticipated, may be indicative of a strategic pivot. An analyst suggests that this move could be a response to a tepid demand within the U.S. market, prompting the company to seek growth opportunities elsewhere. This development reflects the dynamic nature of the global tech industry, where consumer interest and market demand can significantly influence product rollouts and pricing decisions.

Amazon Web Services (AWS) is set to expand its global infrastructure footprint by establishing a new region in Taiwan by early 2025. This strategic move is aimed at catering to the high demand for cloud services in the Asia-Pacific region, a testament to the area’s burgeoning digital economy. AWS’s commitment to Taiwan is further underscored by its plan to invest billions of dollars over the next 15 years, signifying a long-term investment in the technological advancement and digital transformation of the region. This announcement follows closely on the heels of AWS’s recent declaration to infuse an additional $9 billion into Singapore, reinforcing its dedication to enhancing cloud infrastructure and services across the Asia-Pacific. These investments reflect AWS’s confidence in the region’s potential and its role as a pivotal hub in the global cloud services landscape.

Wednesday presents a significant day for economic news, beginning with the crucial consumer price index (CPI) reading for May in the morning. This indicator is a key measure of inflation, reflecting changes in the cost of living by tracking the prices paid by consumers for goods and services. The outcome of this reading could have substantial implications for market expectations and economic forecasting. The day concludes with the Federal Reserve’s policy meeting in the afternoon, an event that holds the financial world’s attention. Decisions made during this meeting, particularly regarding interest rates, are pivotal for the economy and can influence everything from consumer spending to business investment. Together, these events form a potent combination that could set the tone for financial markets and economic policies in the coming months.

Anything is possible as traders and investors react to the big data day with a lot at stake. Keep a close eye on the reaction in bond yields and be prepared for sharp price reactions in the indexes. I would not rule significant point whipsaws as the market reacts so take caution in those quick fear of missing out trades.

Trade Wisely,

Doug

Comments are closed.