As expected the price action reflected uncertainty as the market waited for the release of the CPI inflation data coming out before today. With the market uber-confident, the Fed will begin cutting rates early this year expect substantial price volatility as traders react. There is a lot of blue sky above if the number is bullish but should it prove not to be so bullish be prepared because big point-down moves are also possible. Remember as soon as we are past the morning reaction the market will quickly shift its gaze toward Friday and the big bank report along with a reading on the PPI with a 3-day weekend just beyond. Plan carefully!

Overnight Asian markets closed mostly higher with Japan continuing to surge closing above 35K. European market trade this morning with cautions bullishness waiting on the U.S. data. Futures in the U.S. also suggest a cautiousness pointing to a flat open but that will quickly change after the data is revealed. Anything is possible so be prepared at the market reacts.

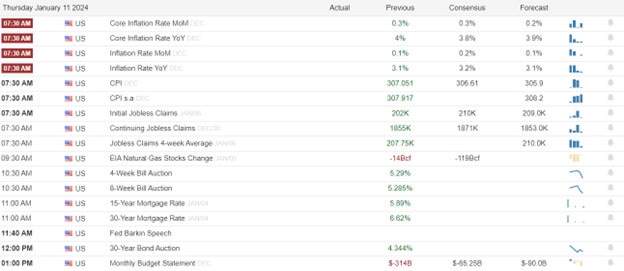

Economic Calendar

Earnings Calendar

Notable reports for Thursday are only INFY.

News & Technicals’

The consumer price index (CPI), a measure of inflation, is expected to have increased by 0.2% in December 2023, bringing the annual inflation rate to 3.2%. This is higher than the Fed’s target of 2% but lower than the peak of 4.5% in June 2023. The Fed has signaled that it will cut interest rates twice in 2024, but the market is pricing in four rate cuts, reflecting a more pessimistic outlook for the economy. The Fed faces a delicate balance between easing too much and risking higher inflation, or easing too little and triggering a recession that many economists have been warning about.

Citigroup’s fourth-quarter earnings will be hit by two major factors: the plummeting value of the Argentine peso and the cost of streamlining its operations. The bank revealed on Wednesday that it suffered $880 million in losses from converting its assets in Argentina to U.S. dollars, as the peso fell by more than 40% in 2023. It also incurred $780 million in expenses related to CEO Jane Fraser’s plan to simplify the bank’s structure and reduce its global footprint. These charges are much higher than the $400 million that CFO Mark Mason had estimated at a Goldman Sachs conference in December. Citigroup will report its fourth-quarter results on Friday morning.

The U.S. Securities and Exchange Commission (SEC) has given the green light to the first bitcoin exchange-traded fund (ETF) in the country. This is a historic moment for the cryptocurrency industry, as it signals the growing acceptance and legitimacy of Bitcoin as an asset class. The approval will pave the way for the Grayscale Bitcoin Trust, the largest holder of Bitcoin with $29 billion in assets, to convert into an ETF and offer investors lower fees and greater liquidity. Other major financial institutions, such as BlackRock and Fidelity, are also expected to launch their own Bitcoin funds in the near future.

Germany is facing a severe transport crisis as train drivers stage a three-day strike over pay and working conditions. The strike, which began on Wednesday and will last until Friday evening, has paralyzed rail services across the country, affecting millions of commuters, travelers, and businesses. The strike comes amid ongoing protests by farmers who are unhappy with the government’s agricultural policies and environmental regulations. Some analysts have compared the situation to a general strike, the likes of which Germany has not seen since 1906. The economy minister, Peter Altmaier, was confronted by angry demonstrators last weekend and had to be escorted by security guards. The social unrest reflects the growing dissatisfaction and frustration among various sectors of German society.

As the market waited for the CPI data, U.S. stocks edged up, except for small-caps which fell slightly in a choppy session. Back in the U.S., the Magnificent 7 (Apple, Amazon, Alphabet, Meta, Microsoft, NVIDIA, and Tesla) continue doing the majority of the work with NVIDIA leading the pack. The efforts of the tech giants may finally achieve an all-time high breakout in the SPY as long as the pending inflation data corporates. Before the bell watch for some price volatility with the release of the CPI report and Jobless Claims. The potential for big point moves is high and watch for whipsaws after the first knee-jerk reaction to the data. Past that we have some bond auctions and more Fed speak to be aware of in the afternoon. Keep in mind the market thinking will quickly shift to the Friday PPI report and kick off to the earnings session with several big bank reports before sliding into a 3-day weekend.

Trade Wisely,

Doug

Comments are closed.