The indexes enjoyed a strong rally and a big reversal in the Dow as buyers rejected the early selling move but it should be noted that volume was a bit anemic at the same time. Big tech names surged sharply as buyers rushed in while defensive sector names also rallied hinting at a possible institutional rotation. Today we have another light day with only International Trade and a Fed speaker left on the economic calendar. However, do have a few more notable earnings reports as a warm-up to the big bank reports beginning on Friday. Keep in mind choppy, volatile price action is likely as we wait for Thursday’s inflation data.

Overnight Asian markets finished mixed with modest gains and losses overall despite the NIKKEI stretching to a 33-year high. European markets see modest declines across the board this morning as they cautiously await the inflation data. U.S. futures also point to a bearish open with the uncertainty of the pending data setting the stage for a big point range-bound choppy consolidation or maybe even a whipsaw as we wait for the CPI numbers.

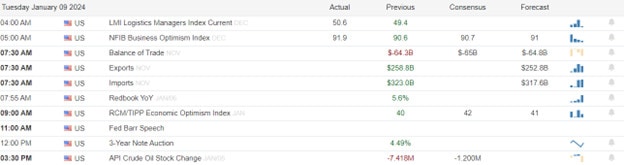

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include AYI, ACI, AZZ, NEOG, PSMT, SGH, SNX, TLRY, and WDFC.

News & Technicals’

A safety issue with Boeing 737 Max 9 planes prompted the Federal Aviation Administration (FAA) to order a temporary grounding of dozens of these planes on Saturday. The FAA’s decision came after Alaska Flight 1282 experienced a midair panel blowout, which was caused by loose hardware in the engine. United Airlines and Alaska Airlines, which operate 737 Max 9 planes, conducted inspections and found similar problems in some of their planes. Boeing, the maker of the planes, said it issued guidance to airlines on how to check and fix the hardware issue.

Samsung Electronics, the world’s leading producer of dynamic random-access memory (DRAM) chips, announced on Tuesday that it expects a sharp decline in its operating profit for the fourth quarter of 2023. The company said that it anticipates an operating profit of 2.8 trillion won for the last three months of the year, which is 35% lower than the 4.31 trillion won it earned in the same period a year ago. The company attributed the drop in profit to weak demand and price competition for its DRAM chips, which are used in various consumer devices such as smartphones and computers.

Unity Software, a company that develops tools and platforms for creating and running interactive content, announced on Monday that it will cut 25% of its staff, or about 1,800 workers, as part of a reorganization plan. The company said that the layoffs are necessary to streamline its operations and focus on its core business, but it could not provide an estimate of the costs and charges associated with the reduction, which it expects to incur mostly in the first quarter of 2024. The layoffs come after a leadership change at Unity, as John Riccitiello stepped down as CEO in October and was replaced by James Whitehurst, the former CEO of Red Hat, as interim CEO.

Stocks ended the trading day with a strong rally on lower-than-average volume, after staying flat for most of the day. The S&P 500 rose 1.4%, recovering much of last week’s losses aided by a surge of buying in big tech names. Technology and growth stocks led the gains, with the Nasdaq rising 2%, while the Dow trailed with a 0.6% increase, dragged down by Boeing shares. The day was quiet in terms of news and economic data, despite the higher close. Expect the markets to be choppy and volatile as we wait for the crucial consumer price index (CPI) data out Thursday morning. Today we have another light day of economic data but a few more notable earnings to inspire the bulls or bears. Plan your risk carefully and try to avoid over-trading with the pending inflation data and big bank earnings beginning on Friday. Anything is possible!

Trade Wisely,

Doug

Comments are closed.