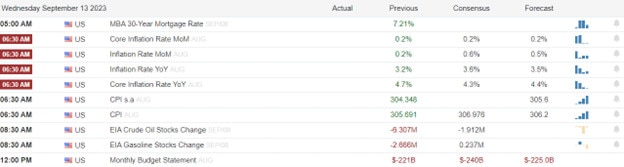

The wait is almost over and hopefully, the indexes can break the low-volume chop with the release of the CPI inflation report. With the headline number expected to rise with the core number expected to decline how the market reacts is anyone’s guess. We will also get Mortgage application data and what could prove to be a very important Petroleum report as energy prices surge putting additional pressures on an already struggling consumer. Keep in mind Thursday morning is also chalked full of potential market-moving reports so plan your risk carefully.

Overnight Asian markets printed red across the board waiting on the inflation reports pending. European markets also started the day bearish waiting on inflation data as the U.K. posted a 0.5% economic contraction in July. U.S. futures point to a modestly bearish open ahead of earnings and economic reports but expect just about anything by the open with all eyes focused on the CPI and what that might mean for the interest rate path forward.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include CBRL & REVG.

News & Technicals’

Apple, the world’s most valuable company, has raised the prices of its iPhone models in two of its key markets, China and India, despite keeping them the same in the U.S. The company announced its new iPhone 13 lineup on Tuesday, which features improved cameras, displays, and batteries. However, customers in China and India will have to pay more to get their hands on the latest devices, as Apple has increased the prices by up to 6% and 8%, respectively, compared to the previous generation. The price hikes are likely due to several factors, such as currency fluctuations, higher taxes and tariffs, and supply chain challenges. Apple is also facing fierce competition from local rivals such as Xiaomi, Oppo, and Vivo, which offer cheaper and more diverse smartphones in these markets. The price hikes could hurt Apple’s sales and market share in China and India, which are the world’s largest and second-largest smartphone markets, respectively.

The U.S. mortgage market is experiencing a historic slump as higher interest rates and low housing inventory discourage potential borrowers. According to the Mortgage Bankers Association, the total mortgage application volume fell by 0.8% last week compared to the previous week, reaching the lowest level since 1996. The decline was driven by a 5% drop in refinancing applications, which were 31% lower than the same week a year ago, when interest rates were around 3%. The average contract interest rate for 30-year fixed-rate mortgages rose to 7.27%, more than a full percentage point higher than a year ago. The purchase applications also fell by 1% week to week and were 27% lower than the same week a year ago, as homebuyers faced limited choices and high prices in the housing market. The adjustable-rate mortgage share of activity increased, indicating that some buyers were trying to lower their monthly payments by opting for riskier loans. The mortgage demand slump could have negative implications for the U.S. economy, as it could reduce consumer spending, home construction, and wealth accumulation.

Equities closed mostly lower Tuesday on another low-volume choppy price action day with investors waiting on the CPI inflation report for August. Analysts suggest headline CPI inflation could move higher while also expecting core inflation to decline. That is a tight line to walk and how the market reacts to such data is anyone’s guess so plan for just about anything this morning. Bond yields are rising this morning ahead of the report adding more uncertainty. Other than that we will get the latest read on Mortgage applications and the very important Petroleum numbers as energy prices continue to surge adding pressure to an already struggling consumer.

Trade Wisely,

Doug

Comments are closed.