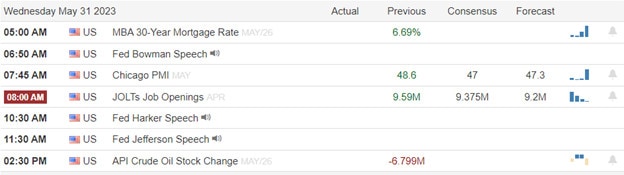

Monday began inspired by a compromise in Congress but the early enthusiasm faded as the path passage looks to have a challenging and uncertain outcome. However, a late-day rally led once again by the very extended tech giants left indexes little changed by the close. Today we have several Fed speakers, Chicago PMI, JOLTS, the Beige Book, and several notable earnings reports to inspire the bulls or bears. Unfortunately, it will be the news about the progress or lack thereof that’s likely to determine the deminer of the market as we wait.

Asian markets traded sharply lower overnight as China’s factory activity numbers disappointed and new signs of real estate defaults reemerge shaking the confidence of recovery. European markets also trade red across the board as they monitor the political wrangling in Congress. U.S. futures though off of their overnight lows continue to point to a bearish open ahead of earnings and economic data with plenty of Fed speak tossed in for good measure.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include AAP, AI, CPRI, CHWY, CONN, CRWD, CRM, DCI, FRO, GME, NTAP, JWN, OKTA, PSTG, TCOM, and VSCO.

News & Technicals’

The U.S. Congress moved closer to averting a historic default on Monday as a bipartisan bill to raise the debt ceiling cleared a crucial hurdle in the House of Representatives. The bill, which would suspend the debt limit until December 2022, passed the House Rules Committee with the support of Rep. Tom Massie, a key Republican swing vote who had previously opposed raising the debt ceiling. The bill now heads to the full House for a final vote, where it is expected to pass with mostly Democratic votes. The Senate had already approved the bill last week with 50 Democrats and 14 Republicans voting in favor. The compromise bill came after weeks of tense negotiations and brinkmanship between the two parties over how to address the debt ceiling, which is the legal limit on how much the federal government can borrow to pay its bills. If Congress fails to raise or suspend the debt ceiling by Monday, the U.S. Treasury would run out of cash and be unable to pay its obligations, triggering a default that could have catastrophic consequences for the global economy.

The CEO of JPMorgan Chase & Co, Jamie Dimon, urged the leaders of the U.S. and China to talk more and solve their problems on Wednesday. He said this during his first trip to China since he said sorry for making a joke about China’s ruling party in 2021. Dimon said the U.S. and China are the biggest economies in the world and they have some issues about trade and security that can be fixed. He said they should not cut off their ties but try to make them safer. Dimon’s bank wants to grow more in China and it was the first foreign bank to own all of its securities business there. The U.S. and China have not been getting along well for a long time and they have been arguing about many things. Last week, some officials from both sides met and talked about trade. On Tuesday, the U.S. said a Chinese plane was too aggressive when it flew near a U.S. plane over the sea.

After a positive start, enthusiasm faded learning that the debt deal had a difficult road to passage whipsawing prices and keeping uncertainty high. The S&P 500 finished flat on Tuesday following news that a tentative agreement on the debt limit has been reached in Washington. Global equities were generally mixed on the day, as were commodities with gold moving higher and oil lower. Interest rates were down with the 10-year Treasury yield back near 3.7%. The technology sector was once again the decisive leader with a handful of tech giants doing most of the work. Today Fed member talk increases with Chicago PMI, JOLTS figures, and the Beige Book this afternoon. Traders will also have some notable earnings to inspire the bulls and bears as we wait on demagoguery and political gamesmanship driving market emotions to end.

Trade Wisely,

Doug

Comments are closed.