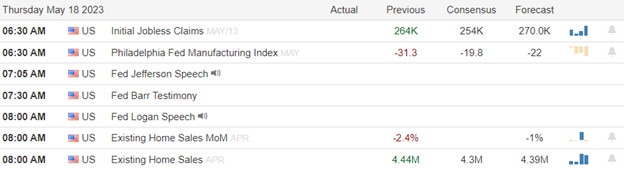

The bulls were energized on Wednesday triggering a short squeeze when both the President and Speaker came out with statements saying they are working together for a deal on the debt ceiling. Unfortunately, the rally didn’t break the trading range of the DIA, SPY, and IWM which has kept indexes trapped for more than one and a half months. Today along with WMT earnings we will get Jobless Claims, the Philly Fed numbers, Existing Home Sales, and more Fed member chatter to add the potential for price volatility.

Asian markets took a cue from the U.S. surge closing the day with gains across the board with the Nikkei leading the way up 1.60%. European markets are also decidedly bullish this morning reacting to the debit ceiling progress hopes. U.S. futures reversed overnight losses to once again suggest a bullish open ahead of potentially market-moving earnings and economic data.

Economic Calendar

Earnings Calendar

Notable reports for Thursday include AMAT, BABA, BBWI, BILI, BRC, COOS, CSIQ, DECK, DOLE, DXC, FTCH, FLO, NIO, NTNX, PLCE, ROST, WMT, VIPS.

News & Technicals’

The global debt has reached a near-record level of $305 trillion, according to the Institute of International Finance (IIF). This is an increase of $45 trillion since the start of the pandemic, driven by unprecedented fiscal and monetary stimulus measures. However, as central banks start to raise interest rates to curb inflation, the debt servicing costs have also risen, creating a “crisis of adaptation” for borrowers and lenders. The IIF warned that the high leverage in the financial system poses significant risks to financial stability and economic growth.

The tech giants are dominating the stock market in 2023, as they continue to grow their profits and expand their businesses. Apple, Alphabet, Amazon, and Microsoft have all increased their share prices by more than 30% since January, while Meta has more than doubled its value. These five companies are outperforming the rest of the market by a wide margin, as the Dow Jones Industrial Average has barely moved in the same period. The tech sector is showing its resilience or is this an irrational move indicating a growing tech bubble?

Target is facing a serious problem of organized retail crime, which is costing the company more money and putting its stores at risk. The company expects to lose $500 million more in 2023 than in 2022 because of theft and damage by criminal groups. Target’s CEO Brian Cornell said the company is taking steps to protect its products and employees and to keep its stores open for customers. Other retailers have also complained about the increase in retail crime and blamed online platforms that allow criminals to sell stolen goods.

The market saw a substantial short squeeze after lawmakers said they are nearing a debt ceiling deal. Both sides said they don’t want to miss the deadline of early June and are working hard to a compromise. The earnings season is wrapping up with reports from big retailers like Walmart and TJX companies later this week. We will also get data from Jobless Claims, Philly Fed, and Existing Home Sales with more Fed speakers throughout the morning. The big question for the day is; Can the bulls follow through with another day of bullishness as the data rolls out? Buckle up for another day where anything is possible!

Trade Wisely,

Doug

Comments are closed.