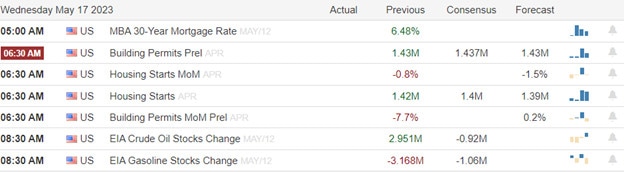

Tuesday turned out to be a rough day for the DIA, SPY, and IWM after the Home Depot miss and a retail sales report that came in short of expectations. Of course, the debit ceiling negotiation cloud hanging over the market didn’t help the overall sentiment but now it seems there has been some progress with the President seeming willing to negotiate. Expect a market reaction if a deal is finally struck. Target’s earning report seems to have left a mixed reaction as evidence of a slowing economy continues to grow. Mortgage Apps, Housing, and Petroleum figures are on deck with several earnings reports that could be market-moving.

Overnight Asian markets traded mixed in reaction to economic data and monitoring debit ceiling negations. However, European markets trade flat to mostly lower this morning with Commerzbank down 6%. On the other hand, U.S. futures seem to have a very different opinion pushing for a bullish open and working to recover some of yesterday’s losses.

Economic Calendar

Earnings Calendar

Notable reports for Wednesday BOOT, CPRT, CSCO, JACK, STNE, SNPS, TTWO, TGT, TJX, TCOM, WIX, & ZTO.

News & Technicals’

According to reports, there was some progress made in the negations of the debit ceiling between the President and the Speaker of the house. This continues to weigh on the mind of the market and as information rolls out on this issue expect it to have market ramifications.

Kraft Heinz is introducing HEINZ REMIX™, a digital sauce dispenser that lets customers create their customized condiments. The dispenser has a touchscreen that offers a choice of four bases and four enhancers, with three intensity levels, resulting in over 200 possible combinations. The company aims to attract consumers who want more variety, spiciness, and sweetness in their sauces and to use the data from the dispenser to inform its future product launches in grocery stores. The innovation is part of Kraft Heinz’s turnaround strategy that focuses on its away-from-home segment.

Target reported better-than-expected earnings for the first quarter of fiscal 2023, despite a slight decline in sales. The retailer earned $1.89 per share, beating the consensus estimate of $1.40 by 35%. However, its revenue fell 0.8% year over year to $25.37 billion, as consumers became more cautious about their spending amid inflation and recession fears. Target’s comparable sales also dipped 0.5% in the quarter. The company said it was focused on investing in its stores, digital capabilities, and merchandise assortment to gain market share and drive long-term growth.

Equities fell on Tuesday after Retail sales missed estimates and Home Depot disappointed on earnings guiding lower for the next quarter. Markets were disappointed by weak consumer-spending data and worried about the debt-ceiling deadline. Small-cap stocks suffered more today, signaling a gloomier economic outlook. This was also reflected in sector performance, with cyclical sectors like energy, real estate, and industrials among the worst performers. Treasury yields edged up slightly on the day with Fed speakers suggesting they will hold the line on rates and still willing to raise them if necessary to achieve their 2% target. Today markets will have Mortgage Applications, Housing Starts, and Peterleum numbers along with several earnings reports with a retail theme for the day.

Trade Wisely,

Doug

Comments are closed.