Indexes churned in a frustrating flat trading rage on Tuesday with the pending CPI report center stage. However, the debt ceiling negotiations and the regional banking stress added to the uncertainty. I would not rule out the possibility of a big point move in the indexes before the market open either up or down reacting to the inflation data. That said, anything is possible with additional volatility created by another big day of earnings data.

Asian market traded lower overnight with an eye on the pending inflation data. European markets are also red this morning waiting in a light volume session ready to react to the pending U.S. report. Ahead of the April consumer price index report U.S. futures trade marginally lower as banking and debit ceiling stresses continue in the background.

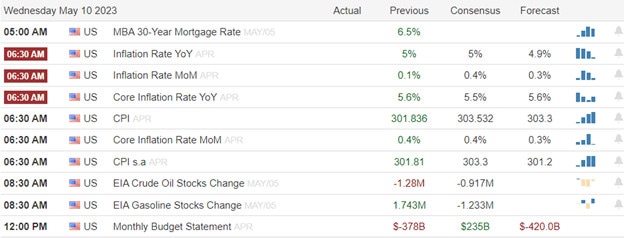

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include ALRM, AAP, BYND, BILI, CAKE, COHR, CRSR, CR, DIS, EBIX, FLEX, GDRX, GRPN, HL, JAZZ, LI, MFC, NYT, NTNX, NTR, OSUR, PAAS, PFGC, REYN, RBA, HOOD, RBLX, SONO, TEVA, TTD, COOK, TUP, U, VVV, VERX, WEN, WWW.

News & Technicals’

Despite the pandemic’s impact on travel, Airbnb achieved its first profitable quarter in Q1 2021, earning $117 million in net income. This was a significant improvement from the net loss of $19 million it posted in Q1 2020. The company also grew its revenue by 5% year-over-year to $1.82 billion, surpassing the expectations of analysts. The revenue growth was fueled by higher demand and prices in North America. However, the company warned that its second-quarter performance might be weaker than expected due to the uncertainty around travel restrictions and the high demand it faced last year.

A White House meeting on Tuesday failed to break the deadlock over the debt ceiling, as President Joe Biden and House Speaker Kevin McCarthy stuck to their opposing positions on how to raise the nation’s borrowing limit before it runs out on June 1st. The meeting, which also included other congressional leaders, did not result in any new progress or agreement on the issue. President Biden called on Congress to pass a clean debt limit increase without any strings attached, while House Speaker McCarthy demanded spending cuts as a condition for any votes to support more borrowing.

Another day of sideways chop as investors monitored banking turmoil, and debit ceiling wrangling while pensive about the pending CPI data. Opinion Survey released yesterday indicated that banks continued to tighten lending standards, but the tightening was not as severe as feared given the recent stress in the banking sector. Nevertheless, with banks less willing to lend and demand for loans weakening, economic growth and inflation will likely slow further in the quarters ahead. We will also get Mortgage data, Petroleum numbers along with another big day of earnings reports to keep traders guessing and price action challenging.

Trade Wisely,

Doug

Comments are closed.