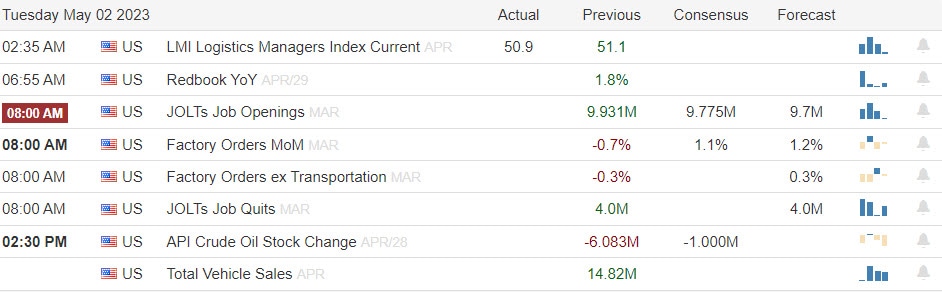

The wait on the Fed began Monday producing a choppy session with little to no concern from investors about the ongoing regional banking declines. We also learned that due to declining tax receipts, the Federal default deadline may be sooner than originally projected. Today we investors will have a lot of earnings data to digest as well as Factory Orders and the JOLTS report. However, don’t be surprised if we see another light volume choppy day as we wait to hear from Jerome Powell on Wednesday afternoon.

Asian markets mostly rallied while we slept with the ASX the only decliner after raising rates by 25 basis points. European markets trade mixed with the FOMC rate decision in focus. U.S. futures point to a slightly lower open ahead of a slew of earnings and economic data with worries about the debt ceiling, regional banks and the pending Fed action swirling.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include ADT, AER, AGCO, ABC, ARNC, AMD, ASH, AXTA, BP, CZR, CHW, LNG, CQP, CHK, CLX, CMI, DENN, DD, ETN, ET, AQUA, EXR, F, FNV, IT, GPK, HLF, HWM, ITW, INCY, JRVR, KAR, TREE, MPC, MAR, MTCH, TAP, NNN, OSH, OKE, OSK, PFE, PACB, PRU, QSR, SEE, SPG, SBUX, SUN, SMCI, SYY, TROW, TRI, UBER, WTI, WU, ZBRA, & YUMC.

News & Technicals’

The US government is facing a looming deadline to raise its debt ceiling or the maximum amount of money it can borrow to pay its bills. The debt ceiling, which is set by Congress, currently stands at $31.4 If the debt ceiling is not raised or suspended by June 1, Treasury Secretary Janet Yellen warned that the US could default on its debt obligations for the first time in history. This could have disastrous consequences for the US economy and global financial stability, as investors would lose confidence in the US dollar and the government would have to cut spending on essential services. President Joe Biden has invited the top four congressional leaders to a meeting at the White House on May 9 to discuss the debt limit issue. However, Republicans and Democrats have different views on how to address the debt problem, and a compromise may be hard to reach.

Shein is a company that sells cheap clothes online. It started in China. Some people in the US government are worried that Shein uses workers who are not paid or treated well. These workers are from a group of people called Uyghurs who live in China. The US government does not like how China treats Uyghurs. The US government wants to stop Shein from selling its shares to the public in the US. They want Shein to prove that it does not use bad workers. Shein says it does not use bad workers and it follows the rules.

Stocks did not change much on Monday chopping in a range as wait on the FOMC began. Talking heads seem to make light of 3rd bank’s failure as the pressures on regional banks continue and the market appears willing to ignore the situation. The federal default deadline is back in the news today due to declining tax revenues further complicating the Fed rate decision Wednesday afternoon. Today we investors have big wave earnings data to react to as well as Factory orders and the JOLTS report. Don’t be surprised if we see another choppy day with Jerome Powell’s comments pending.

Trade Wisely,

Doug

Comments are closed.