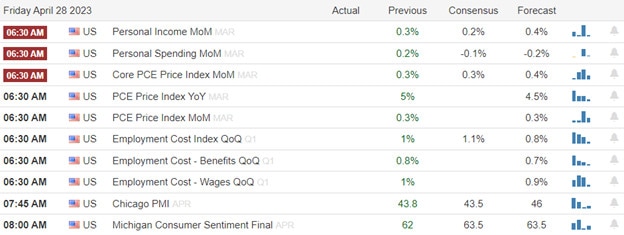

With earnings as the focal point indexes surged on Thursday as investors averted their eyes from the regional banking crisis. Unfortunately, the situation seems to have worsened for FRC over the last 24 hours and some suggest an action by the Fed may be required as soon as this weekend. The very bullish reaction to the initial AMZN and INTC earnings seems to have tempered after the conference calls. Today we have fewer earnings events but have several potential market-moving economic reports highlighting the Feds favored core PCE number before the bell. Buckle up it could be a wild Friday session.

Asian market surged higher in overnight trading as Japan keeps monetary policy unchanged weakening the Yen. However, European indexes see only red this morning after a 0.1% GPD number with sinking bank prices raising concerns. With bank worries back in focus this morning and tempered excitement from after-the-bell earnings reports U.S. futures point to bearish open.

Economic Calendar

Earnings Calendar

Notable reports for Friday AON, ARES, BLMN, CCJ, GTLS, CHTR, CVX, CL, XOM, LYB, NWL, NIO, SAIA, SLCA, WPC, & WT.

News & Technicals’

Amazon, the e-commerce giant and cloud leader, reported its first quarter earnings for 2023 on Thursday, April 28. The company beat analyst expectations on both revenue and profit, posting $127.4 billion in revenue and $3.2 billion in profit, or 31 cents per share. However, the company also warned of a slowdown in its cloud segment AWS, which grew 16% year-over-year, compared to 37% in the same period last year. Amazon’s online retail business also saw no growth in the first quarter, as shoppers became more cautious and less reliant on e-commerce amid the pandemic. Amazon’s stock rose 9% in after-hours trading following the earnings release.

Intel, the semiconductor giant, and PC chip leader, reported its first-quarter earnings for 2023 on Wednesday, April 27. The company reported the largest quarterly loss in its history, losing $2.8 billion, or 66 cents per share, compared to a profit of $8.1 billion, or $1.98 per share, a year ago. Revenue fell nearly 36% year over year to $11.7 billion, as the company faced fierce competition from rivals like AMD and Nvidia, as well as supply chain challenges and a global chip shortage. Intel also lowered its full-year guidance, expecting to lose $2.30 per share on revenue of $65 billion to $68 billion. Intel’s stock dropped 5% in after-hours trading following the earnings release.

The U.S. stock market earnings as the focal point, and tech companies have been delivering strong results that have boosted investor confidence and key indexes. Microsoft and Alphabet surprised the market with their earnings yesterday, and META followed suit today with a beat that sent its shares up 14%. The earnings season is not over yet, and Amazon could be the next big mover when it reports later today. The U.S. economy, however, is slowing down, according to the GDP report released this morning. This suggests that the Fed will not raise rates much more, but also that it will not cut them soon either, as inflation remains high.

Trade Wisely,

Doug

Comments are closed.