Tuesday proved to be a day of frustrating low-volume chop as the market waited for NFLX earnings after GS dampened early bullishness missing expectations. Bond yields rose yesterday and look to extend higher this morning with the U.K. reporting a 10.1% inflation rate above estimates. Today we have a light day on the economic calendar but we ramp up the earnings data with MS this morning and TSLA this afternoon we should expect another day of challenging price action.

Asian markets finished the day mixed but mainly lower worried about rate hikes and possible recession. The surprise U.K. inflation rate and uncertainty of the Fed’s next rate decision have European markets seeing red across all indexes this morning. As investors digest earnings miss from GS and NFLX, the U.S. point to bearish open as we ramp up the number of reports with confidence in the results slightly fading. Be watchful for big-point intraday whipsaw or full-on reversals as traders react to the data.

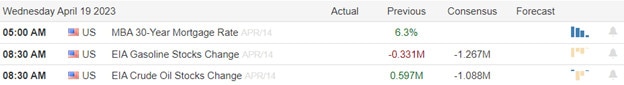

Economic Calendar

Earnings Calendar

Notable earnings for Wednesday include ABT, AA, ALLY, ASML, BKR, CNS, CCI, DFS, EFX, FFIV, IBM, KMI, LRCX, LVS, MS, NDAQ, EDU, REXR, SLG, STLD, SYF, TRV, TSLA, USB, &ZION.

News & Technicals’

According to the Office for National Statistics, the consumer price index rose by an annual 10.1% in March 2023 in the UK. This is above a consensus projection of 9.8% in a Reuters poll of economists. The inflation rate remained in double digits as households continued to grapple with soaring food and energy bills. This is a slight dip from the unexpected jump to 10.4% in February, which broke three consecutive months of declines since October’s 41-year high of 11.1%.

Netflix released its first-quarter 2023 financial results on April 18th, 2023. The company outperformed expectations for the first quarter financial results, delivering a 16% positive surprise in earnings per share ($0.94 vs. $0.80 anticipated) and a 5% positive surprise in revenues ($26.39 billion vs. $25.19 billion). Netflix said it was pushing back the broad rollout of its password-sharing crackdown. Originally, Netflix wanted the rollout to take place late in the first quarter, but on Tuesday it said it would do it in the second quarter. The company said it saw its subscriber growth impacted in the international markets where it has already rolled out such initiatives.

On Wednesday, U.S. Treasury yields climbed after another sticky inflation report in the U.K. raised concerns global central banks would need to stay the course with their tightening campaigns. The yield on the 10-year Treasury was up by over 6 basis points to .63%. The yield on the 2-year Treasury was last trading at 4.28% after rising by 8 basis points.

Equity markets were mixed on Tuesday, as the S&P 500 closed higher after a frustrating day of low-volume chop. Forecasts still call for -6.5% earnings growth year-over-year in the first quarter. The S&P 500 overall is up about 8.0% in 2023, still driven largely by growth sectors like technology and communication services. More recently, we have seen better performance from defensive sectors, like consumer staples and health care, and cyclical sectors, including energy and materials. This comes as Treasury yields have moved higher, with the 2-year U.S. Treasury yield up by nearly 0.46% since its recent lows to 4.22% 1. The VIX volatility index has also moved lower, down about 9% in April thus far. Index technicals remain bullish but once again over-extended according to the T2122 indicator.

Trade Wisely,

Doug

Comments are closed.