With the decline in the JOLTS report the market acknowledged the slowing economy and worries about a recession reliving some of the overbought conditions with some profit-taking. Though the indexes pulled back no substantial technical damage occurred except for the lower high at price resistance in the IWM. One day does not make a trend so it will be very important to see if the bears can follow through today or if the bulls have the energy to defend and recover. Prepare for just about anything as the market reacts to the economic reports and continue to watch out for the big point whipsaws plaguing the market of late.

While we slept Asian markets closed mixed as New Zealand hiked interest rates by 50 basis points. European markets trade mostly lower as slowing economies and recession worries resurface. At the time of writing this report, U.S. futures suggest a slightly bearish open that could easily improve or worsen as the pending economic data is revealed.

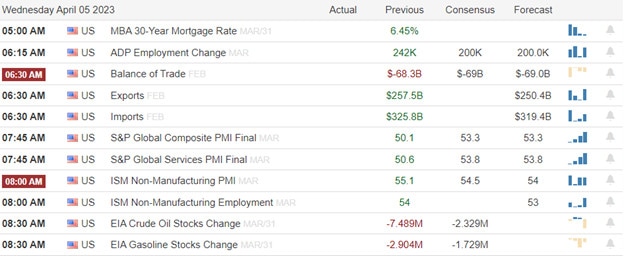

Economic Calendar

Earnings Calendar

Notable reports for Wednesday include CAG, SCHN & SMPL.

News & Technicals’

Johnson & Johnson has agreed to pay $8.9 billion over the next 25 years to settle allegations that the company’s baby powder and other talc products caused cancer. The proposed settlement was announced in a securities filing and would require approval in bankruptcy court. J&J’s subsidiary LTL Management also refiled for Chapter 11 bankruptcy protection after its first attempt was thwarted. More than 60,000 claimants have committed to support the proposed resolution, according to the filing.

Virgin Orbit’s outgoing Chief Operating Officer Tony Gingiss sent a companywide email that appears to call out Virgin Orbit CEO Dan Hart, although not by name. Gingiss offered an apology to employees that they “have not heard from the person who should be saying it.” Virgin Orbit filed for Chapter 11 bankruptcy protection on Tuesday and noted in a securities filing that Gingiss was laid off as one of the 675 positions eliminated.

Federal Reserve Bank of Cleveland President Loretta Mester said on Tuesday that the U.S. central bank likely has more interest rate rises ahead amid signs that recent banking sector troubles have been contained. To keep inflation on a sustained downward path to 2% and keep inflation expectations anchored, Mester said she sees monetary policy moving “somewhat further into restrictive territory this year, with the fed funds rate moving above 5% and the real fed funds rate staying in positive territory for some time.”

Although the economic data has suggested we’ve had a slowing economy for some time the market decided yesterday with the decline in the JOLTS report to acknowledge the weakness. The Tuesday selling relieved some of the overbought condition as the dollar weakened and the precious metals surged as the worries of recession circulated. However, no significant technical damage occurred though the price patterns likely raised the level of uncertainty. Continue to watch for whipsaws as markets react to economic data with special attention to the oil numbers in light of the OPEC decision and its recent surge higher.

Trade Wisely,

Doug

Comments are closed.