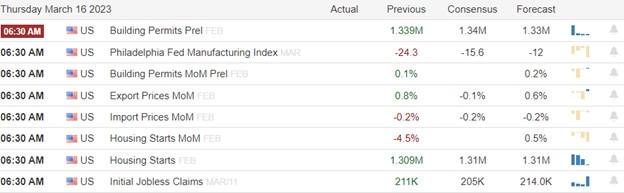

The painful overnight reversal on Wednesday on the spreading banking contagion subsided by the end of the day as Credit Suisse found another benefactor to backstop the embattled bank, sparking an end-of-day rally. However, if a relief rally can begin, we must first get past Housing, Jobless, Pilly Fed, and Import/Export economic reports before the bell. Once again, anything is possible as investors try to digest all the data to predict what the FOMC will do next week. So expect the challenging price action to persist as the bulls and bears slug it out for directional control.

Asian markets saw declines across the board as we slept with investors grappling over what comes next in the pending FOMC decision. However, European markets feel much better this morning as Credit Suisse recovers after burrowing 54 billion from Swiss National. With market-moving economic reports just around the corner, U.S. futures suggest a mixed open, but everything could quickly change after the data release. Plan for another volatile morning with significant price swings possible before the opening.

Economic Calendar

Earnings Calendar

Notable reports for Thursday include ASO, AUY, DBI, DG, COOK, FDX, GIII, MOMO, HNST, JBL, SIG, TITN & WSM.

News & Technicals’

Wall Street has been debating whether the economy is heading into a recession for months. However, the rapid market moves after the regional bank failures in the U.S. has some strategists now expecting a contraction in the economy to come sooner. Economists are also ratcheting down their growth forecasts on the assumption there will be a pullback in bank lending.

Credit Suisse will borrow up to 50 billion Swiss francs ($53.68 billion) from the Swiss National Bank under a covered loan facility and a short-term liquidity facility. The measures come after the lender’s shares saw sharp declines on Wednesday after its top investor Saudi National Bank said it could not provide further assistance.

Snap shares surged nearly 8% to $11.15, while Meta shares rose slightly over 3% to $203.49 after The Wall Street Journal reported that TikTok faces a possible ban in the U.S. if ByteDance fails to comply with the Biden Administration’s proposition. Investors believe that if TikTok were to be banned in the U.S., social media companies like Snapchat and Meta would regain users lost to the short-form video platform. However, ByteDance said, “If protecting national security is the objective, divestment doesn’t solve the problem: a change in ownership would not impose any new restrictions on data flows or access.”

Wednesday’s significant overnight reversal saw the Dow sink 700 points before whipsawing and recovering nearly 400 points by the close as worries over the spreading banking contagion subsided. While the DIA, SPY, and IWM saw a rough day, the QQQ, led by the big tech giants, traded like nothing was happening, retesting its downtrend. The T2122 suggests we are overdue for a relief rally. Perhaps with the Swiss National Bank providing a backstop for Credit Suisse, the banking fears will subside slightly, encouraging the bulls to defend recent support levels. Of course, to do that, we will need to get past the Housing, Jobless, Pilly Fed, and Import/Export reports that could encourage the bulls or the bears. Plan for another wild day ahead.

Trade Wisely,

Doug

Comments are closed.